Bad Banks media release

24 December 2009

“It’s great news that the Aussie-owned banks have to pay up their unpaid tax,” says Vaughan Gunson, Bad Banks campaign manager. “It’s a defeat for them.” [See NZ Herald article Banks to pay taxman billions]

“It shows that big corporations can be brought into line. While the IRD had the law on its side, we shouldn’t underestimate the role mass public opinion has played in getting the banks to cough up,” says Gunson.

Bad Banks campaigners have been on the streets over the last few months handing out leaflets with information on the banks and the world economic crisis. “We’ve found there’s a real bad mood against the banks,” says Gunson.

“People know the Aussie banks have been making exorbitant profits over the last decade by charging high interest rates for mortgages and credit cards, high fees, and through mega-scale tax avoidance,” says Gunson.

People have been telling us, “Yes, the banks are bad”, “They’re ripping us off big time”, “The banks want to turn us all into debt slaves”.

“And there’s a high level of awareness that it’s the global banking cartels who are responsible for the world economic crisis which is causing large-scale job losses in New Zealand, along with widespread clamps on wages and salaries,” says Gunson.

“The banks and other corporates are trying to make ordinary working people bear the cost of the crisis. We need to resist,” says Gunson.

“To make the big banks and financial speculators pay we’re campaigning for the introduction of a Financial Transaction Tax. A small percentage tax on every financial transaction would net hundreds of millions from banks and international speculators who shift billions and billions of dollars around every year,” says Gunson.

“A tax that targets the mega-rich would allow us to shift the tax burden off low and middle income earners,” says Gunson. “We could take GST off food, which would be a big help to grassroots New Zealanders struggling to pay the bills.”

“Just because the banks have been forced to pay their unpaid tax bill, doesn’t mean they should be let of the hook,” says Gunson. “To protect our people we urgently need major reform of the banking industry.”

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks chucking "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand .

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand , with public meetings held throughout the country, so that grassroots people can tell their stories.

For more comment, contact:

Vaughan Gunson

Bad Banks campaign manager

(09)433 8897

021-0415 082

svpl@xtra.co.nz

See also the media release from CAFCA, IRD Delivers Best Possible Xmas Present To Long Suffering Kiwi Taxpayers.

23.12.09

Latest UNITY Journal - Bad Banks: What are the alternatives?

CONTENTS

5 A "public option" against the banks

DAPHNE LAWLESS, editor of UNITY

11 Targeting capitalism's exploitation of labour and nature

GRANT MORGAN, Socialist Worker (NZ)

15 The "collapse" of global capitalism

GRANT MORGAN

18 Target Bad Banks and you target neo-liberalism

VAUGHAN GUNSON, Socialist Worker (NZ)

22 Market volatility and profitability crisis

GRANT MORGAN

25 An end to private banks

SUE BRADFORD, former Green Party MP

32 Bank and tax systems due for overhaul

RUSSEL NORMAN MP, Green Party leader

33 Inquiry shows need for govt to act

FINSEC

34 Aussie tax-dodging robber banks

MURRAY HORTON, Campaign against Foreign Control of Aotearoa

35 Protecting New Zealand jobs through bank guarantee schemes

FINSEC

39 Is it "Kiwi" to be anti-union?

VAUGHAN GUNSON interviews Andrew Campbell

41 CTU conference 2009: can unions build an alternative?

GRANT BROOKES, New Zealand Nurses Organisation

45 What's a "fractional reserve"?

DAPHNE LAWLESS

47 Banks, money and thin air

ADAM BUICK, Socialist Party of Great Britain

50 Socialist Worker Appeal

55 Ron Paul: a right-wing alternative?

PETER De WAAL, Socialist Worker (NZ)

60 Why community currencies?

DEIDRE KENT, Living Economies

63 Financial Transactions Tax: making Wall Street pay

DEAN BAKER, Center for Economic and Policy Research

65 Our alternative to market madness

CHRIS HARMAN, Socialist Workers Party (Britain)

70 Is nationalization socialism?

YEN CHU, No-one Is Illegal (Canada)

74 Venezuela closes banks

BRONWEN BEECHEY, Socialist Worker (NZ)

78 Latin America's economic rebels

MARK WEISBROT, Center for Economic and Policy Research

81 Feedback: letters from David Frazer, Peter de Waal, Pat O'Dea and David Colyer

To purchase a copy of this issue ($5 plus postage) contact Len, email organiser@sworker.pl.net, or phone (09)634 3984.

To subscribe to UNITY Journal ($25 for four issues a year) contact Grant, grantmorgan@paradise.net.nz. Send a cheque made out to 'UNITY' to Box 13-685, Auckland, NZ, along with your postal details.

Société Générale Predicts Global Economic Collapse In Two Years Time

by Ambrose Evans-Pritchard

22 December 2009

from Telegraph.co.uk

Société Générale has advised clients to be ready for a possible "global economic collapse" over the next two years, mapping a strategy of defensive investments to avoid wealth destruction.

In a report entitled "Worst-case debt scenario", the bank's asset team said state rescue packages over the last year have merely transferred private liabilities onto sagging sovereign shoulders, creating a fresh set of problems.

Overall debt is still far too high in almost all rich economies as a share of GDP (350pc in the US), whether public or private. It must be reduced by the hard slog of "deleveraging", for years.

"As yet, nobody can say with any certainty whether we have in fact escaped the prospect of a global economic collapse," said the 68-page report, headed by asset chief Daniel Fermon. It is an exploration of the dangers, not a forecast.

Under the French bank's "Bear Case" scenario (the gloomiest of three possible outcomes), the dollar would slide further and global equities would retest the March lows. Property prices would tumble again. Oil would fall back to $50 in 2010.

Governments have already shot their fiscal bolts. Even without fresh spending, public debt would explode within two years to 105pc of GDP in the UK, 125pc in the US and the eurozone, and 270pc in Japan. Worldwide state debt would reach $45 trillion, up two-and-a-half times in a decade.

(UK figures look low because debt started from a low base. Mr Ferman said the UK would converge with Europe at 130pc of GDP by 2015 under the bear case).

The underlying debt burden is greater than it was after the Second World War, when nominal levels looked similar. Ageing populations will make it harder to erode debt through growth. "High public debt looks entirely unsustainable in the long run. We have almost reached a point of no return for government debt," it said.

Inflating debt away might be seen by some governments as a lesser of evils.

If so, gold would go "up, and up, and up" as the only safe haven from fiat paper money. Private debt is also crippling. Even if the US savings rate stabilises at 7pc, and all of it is used to pay down debt, it will still take nine years for households to reduce debt/income ratios to the safe levels of the 1980s.

The bank said the current crisis displays "compelling similarities" with Japan during its Lost Decade (or two), with a big difference: Japan was able to stay afloat by exporting into a robust global economy and by letting the yen fall. It is not possible for half the world to pursue this strategy at the same time.

SocGen advises bears to sell the dollar and to "short" cyclical equities such as technology, auto, and travel to avoid being caught in the "inherent deflationary spiral". Emerging markets would not be spared. Paradoxically, they are more leveraged to the US growth than Wall Street itself. Farm commodities would hold up well, led by sugar.

Mr Fermon said junk bonds would lose 31pc of their value in 2010 alone. However, sovereign bonds would "generate turbo-charged returns" mimicking the secular slide in yields seen in Japan as the slump ground on. At one point Japan's 10-year yield dropped to 0.40pc. The Fed would hold down yields by purchasing more bonds. The European Central Bank would do less, for political reasons.

SocGen's case for buying sovereign bonds is controversial. A number of funds doubt whether the Japan scenario will be repeated, not least because Tokyo itself may be on the cusp of a debt compound crisis.

Mr Fermon said his report had electrified clients on both sides of the Atlantic. "Everybody wants to know what the impact will be. A lot of hedge funds and bankers are worried," he said.

22 December 2009

from Telegraph.co.uk

Société Générale has advised clients to be ready for a possible "global economic collapse" over the next two years, mapping a strategy of defensive investments to avoid wealth destruction.

In a report entitled "Worst-case debt scenario", the bank's asset team said state rescue packages over the last year have merely transferred private liabilities onto sagging sovereign shoulders, creating a fresh set of problems.

Overall debt is still far too high in almost all rich economies as a share of GDP (350pc in the US), whether public or private. It must be reduced by the hard slog of "deleveraging", for years.

"As yet, nobody can say with any certainty whether we have in fact escaped the prospect of a global economic collapse," said the 68-page report, headed by asset chief Daniel Fermon. It is an exploration of the dangers, not a forecast.

Under the French bank's "Bear Case" scenario (the gloomiest of three possible outcomes), the dollar would slide further and global equities would retest the March lows. Property prices would tumble again. Oil would fall back to $50 in 2010.

Governments have already shot their fiscal bolts. Even without fresh spending, public debt would explode within two years to 105pc of GDP in the UK, 125pc in the US and the eurozone, and 270pc in Japan. Worldwide state debt would reach $45 trillion, up two-and-a-half times in a decade.

(UK figures look low because debt started from a low base. Mr Ferman said the UK would converge with Europe at 130pc of GDP by 2015 under the bear case).

The underlying debt burden is greater than it was after the Second World War, when nominal levels looked similar. Ageing populations will make it harder to erode debt through growth. "High public debt looks entirely unsustainable in the long run. We have almost reached a point of no return for government debt," it said.

Inflating debt away might be seen by some governments as a lesser of evils.

If so, gold would go "up, and up, and up" as the only safe haven from fiat paper money. Private debt is also crippling. Even if the US savings rate stabilises at 7pc, and all of it is used to pay down debt, it will still take nine years for households to reduce debt/income ratios to the safe levels of the 1980s.

The bank said the current crisis displays "compelling similarities" with Japan during its Lost Decade (or two), with a big difference: Japan was able to stay afloat by exporting into a robust global economy and by letting the yen fall. It is not possible for half the world to pursue this strategy at the same time.

SocGen advises bears to sell the dollar and to "short" cyclical equities such as technology, auto, and travel to avoid being caught in the "inherent deflationary spiral". Emerging markets would not be spared. Paradoxically, they are more leveraged to the US growth than Wall Street itself. Farm commodities would hold up well, led by sugar.

Mr Fermon said junk bonds would lose 31pc of their value in 2010 alone. However, sovereign bonds would "generate turbo-charged returns" mimicking the secular slide in yields seen in Japan as the slump ground on. At one point Japan's 10-year yield dropped to 0.40pc. The Fed would hold down yields by purchasing more bonds. The European Central Bank would do less, for political reasons.

SocGen's case for buying sovereign bonds is controversial. A number of funds doubt whether the Japan scenario will be repeated, not least because Tokyo itself may be on the cusp of a debt compound crisis.

Mr Fermon said his report had electrified clients on both sides of the Atlantic. "Everybody wants to know what the impact will be. A lot of hedge funds and bankers are worried," he said.

22.12.09

Bad Banks "exposures" of ASB - Auckland and Whangarei

Bad Banks campaigners outside ASB Bank on Queen Street.

The leaflet also linked this particular Bad Bank to the international bank cartels responsible for the global financial implosion and their role in blocking meaningful action on climate change. From the leaflet:

"This implosion sparked the world economic crisis which is today causing large-scale job losses in New Zealand, along with widespread clamps on wages and salaries.The leaflet was positively received, with a few hundred handed out in Auckland and close to a hundred in Whangarei. A dozen people filled out the contact sheet to keep in touch with the campaign.

The international bank cartels (to which ASB is affiliated) control global investment flows chasing after maximum profits, at the expense of social and ecological welfare. Thus the world’s bankers are choking off vital “green energy” investments needed to save humanity from climate chaos and oil depletion."

Regular Bad Banks stalls or "leaflet drops" are essential. Being out on the street, in tandem with our media work, will raise the profile of the campaign. People will see us and remember us. They will respect us for doing the hard yards.

And by being active and handing out leaflets we're able to engage with people. We can then gauge what issues and ideas are really connecting with them. The questions people are ask, the conversations we have, can all be fed back into the campaign, so that it becomes a living and evolving thing. That way it has the best chance of becoming a popular movement.

Next year

If you would like to get involved with Bad Banks stalls next year contact Vaughan Gunson, email svpl@xtra.co.nz or ph/txt 021-0415 082. We can arrange for a bunch of leaflets and other campaign material to be sent to you.

It's possible to do a stall with just one or two people. Give it a go. You’ll get a positive reception from most people. And by getting out there you’ll inspire others to help out. Because of the simmering mood against the banks you’ll come into contact with people who are looking to get involved in a campaign like this.

It should be possible next year to get regular Bad Banks stalls and other campaign initiatives happening in a number of cities around New Zealand. That’s the goal.

A new person signs up to the Bad Banks campaign, while Peter and Len are engaged in conversations (about Bad Banks of course). Queen Street, Auckland.

Vaughan and Aaron (Green Party activist) outside an ASB in Whangarei. A positive reception to Bad Banks leaflets from most people. The ASB Regional Manager for Northland was not so keen.

21.12.09

Calling the bankers' bluff over tax

by Ruth Sunderlund

from The Observer

22 December 2009

It's fortunate for a number of reasons that the British Airways cabin crew strike has been averted - not least because disenchanted London bankers can head for Heathrow airport right now, if that's what they really want.

The argument that banks and bankers are highly mobile and would leave London if provoked is endlessly deployed to defend bonuses, but it is not interrogated nearly enough. Now Andy Haldane, the Bank of England's head of financial stability, has called the bankers' bluff. He is on safe ground to suppose there will not be overspill in the departure lounge.

Hedge funds and small financial outfits might be reasonably footloose, but big banks are much less so. And where would the refugee bankers, fleeing cruel persecution in Britain, find sanctuary? If they really want to turn their backs on advantages such as the English language, the favourable time zone, the world-class cultural life and the honeypot of business services in London, they would have to find a jurisdiction prepared to underwrite their activities.

Tax havens such as the Cayman Islands have been overbalanced by the credit crunch and would not be capable of doing so. Traditional magnets such as Switzerland are stretched to breaking point by supporting their existing banks - they would not want to take on responsibility for any more. And why would the US, or China, contemplate burdening their taxpayers with institutions that define themselves as too buccaneering for Britain?

I'm not sure what the optimal size of the financial sector is, but given that taxpayer bailouts are an integral feature of the industry, occurring periodically and costing more each time, it is not in the least obvious that bigger is better. Proportionately, public sector interventions in Britain during the financial crisis were much larger than in the US or the euro area, reaching more than 70 per cent of GDP this year.

The problem with relying so heavily on financial services is that we are hanging our national fortunes on a sector that is potentially very lucrative, but also ruinously risky.

Health, not size, is key.

Haldane's comments are not only interesting in themselves, but because they appear to be a harbinger of a tougher stance. The Bank of England's latest financial stability report urges the banks to replenish their capital now, while the sun is, if not shining brightly, at least casting a few wintry rays.

It wants to see them start a virtuous circle, by retaining more capital instead of paying bonuses and dividends. That would send down the cost of funds, which in turn would get credit flowing through the economy. Non-financial companies would then perform better, resulting in lower loan losses for banks.

In the long term, everybody's happy. In the short term, bank shareholders will squeal - share prices have already fallen in response to the Chancellor Alistair Darling's bonus tax - and the bonus lobby will cry that it is infringing their basic human right to the moolah.

The bank's exhortations come against a background of international reform. The Basel committee on banking supervision is suggesting a series of measures, including proposals that would limit the ability of banks to pay bonuses and dividends if their capital dropped close to the minimum required.

The system looks more stable and more resilient than it did six months ago, but there is a very difficult road ahead. Next year, we can expect progress on an international level on improving the regulation of capital and liquidity.

It will take longer to resolve two parallel debates: The first is around dynamic provisioning - or whether central banks can let the air out of bubbles before they burst, by insisting that banks build up cushions of capital in the good times to soften their landings in the bad. The second is about firms that are too big to fail - how they can be wound up with the least possible damage, and whether there should be a separation of utility banking from the casino variety as I have advocated, and far more importantly, as has the bank's governor, Mervyn King.

People are calling this an "ice age" for bankers, but it is blatantly premature for them to be receiving bonuses off the back of free money injected by central banks, at a time when there are still enormous risks.

Some individual households are very highly leveraged and vulnerable to a rise in interest rates. Potentially bad loans in the commercial property sector are looming like a black cloud: £160 billion ($364 billion) of loans are due to be refinanced by 2013. So far, we have only had a liquidity crisis - the real credit crisis is yet to happen.

from The Observer

22 December 2009

It's fortunate for a number of reasons that the British Airways cabin crew strike has been averted - not least because disenchanted London bankers can head for Heathrow airport right now, if that's what they really want.

The argument that banks and bankers are highly mobile and would leave London if provoked is endlessly deployed to defend bonuses, but it is not interrogated nearly enough. Now Andy Haldane, the Bank of England's head of financial stability, has called the bankers' bluff. He is on safe ground to suppose there will not be overspill in the departure lounge.

Hedge funds and small financial outfits might be reasonably footloose, but big banks are much less so. And where would the refugee bankers, fleeing cruel persecution in Britain, find sanctuary? If they really want to turn their backs on advantages such as the English language, the favourable time zone, the world-class cultural life and the honeypot of business services in London, they would have to find a jurisdiction prepared to underwrite their activities.

Tax havens such as the Cayman Islands have been overbalanced by the credit crunch and would not be capable of doing so. Traditional magnets such as Switzerland are stretched to breaking point by supporting their existing banks - they would not want to take on responsibility for any more. And why would the US, or China, contemplate burdening their taxpayers with institutions that define themselves as too buccaneering for Britain?

I'm not sure what the optimal size of the financial sector is, but given that taxpayer bailouts are an integral feature of the industry, occurring periodically and costing more each time, it is not in the least obvious that bigger is better. Proportionately, public sector interventions in Britain during the financial crisis were much larger than in the US or the euro area, reaching more than 70 per cent of GDP this year.

The problem with relying so heavily on financial services is that we are hanging our national fortunes on a sector that is potentially very lucrative, but also ruinously risky.

Health, not size, is key.

Haldane's comments are not only interesting in themselves, but because they appear to be a harbinger of a tougher stance. The Bank of England's latest financial stability report urges the banks to replenish their capital now, while the sun is, if not shining brightly, at least casting a few wintry rays.

It wants to see them start a virtuous circle, by retaining more capital instead of paying bonuses and dividends. That would send down the cost of funds, which in turn would get credit flowing through the economy. Non-financial companies would then perform better, resulting in lower loan losses for banks.

In the long term, everybody's happy. In the short term, bank shareholders will squeal - share prices have already fallen in response to the Chancellor Alistair Darling's bonus tax - and the bonus lobby will cry that it is infringing their basic human right to the moolah.

The bank's exhortations come against a background of international reform. The Basel committee on banking supervision is suggesting a series of measures, including proposals that would limit the ability of banks to pay bonuses and dividends if their capital dropped close to the minimum required.

The system looks more stable and more resilient than it did six months ago, but there is a very difficult road ahead. Next year, we can expect progress on an international level on improving the regulation of capital and liquidity.

It will take longer to resolve two parallel debates: The first is around dynamic provisioning - or whether central banks can let the air out of bubbles before they burst, by insisting that banks build up cushions of capital in the good times to soften their landings in the bad. The second is about firms that are too big to fail - how they can be wound up with the least possible damage, and whether there should be a separation of utility banking from the casino variety as I have advocated, and far more importantly, as has the bank's governor, Mervyn King.

People are calling this an "ice age" for bankers, but it is blatantly premature for them to be receiving bonuses off the back of free money injected by central banks, at a time when there are still enormous risks.

Some individual households are very highly leveraged and vulnerable to a rise in interest rates. Potentially bad loans in the commercial property sector are looming like a black cloud: £160 billion ($364 billion) of loans are due to be refinanced by 2013. So far, we have only had a liquidity crisis - the real credit crisis is yet to happen.

20.12.09

Kiwibank should be turned into proper public bank

Bad Banks media release

20 December 2009

An article in the Sunday Star Times, Anger at Kiwibank closures (20 Dec 2009), outlines plans by Kiwibank to close 20 branches nationwide. A cost saving initiative by the bank.

"This decision by Kiwibank bosses shows that when it comes to maintaining its "bottom line" there's not much difference between Kiwibank and the other banks, " says Vaughan Gunson, Bad Banks campaign manager.

"Kiwibank has tried to market its difference to the Aussie banks (ANZ National, BNZ, Westpac and ASB) who dominate the banking industry in New Zealand, but the reality is simply that Kiwibank currently doesn't offer much of an alternative," says Gunson. "That's because Kiwibank was founded by the government in 2002 to operate as a business, one that has to compete "fairly" with other banks, and at the same time deliver a return to the government."

The comment in the Sunday Star Times article by Jim Anderton, leader of the Progressive Party and proponent of Kiwibank, reveals the limits of the market model that Kiwibank operates under. Anderton justified the closures on the grounds that this is "what happens with a modern business".

"Anderton is right," says Gunson, "a modern business serves its own purpose, not the wider needs of the community. This is the whole problem with the banking sector in this country and internationally".

"The financial implosion that almost brought down the global economy last year, and which is continuing to wreck havoc on the lives of grassroots people, shows that we need to urgently rein in the power of the banks, " says Gunson. "Turning Kiwibank into a proper public bank would be a good start."

"A proper public bank", says Gunson, "could offer 3% state loans to first home buyers and zero-fee banking to low and middle income people. Such bold and sensible initiatives would transform banking in this country."

"Public service banking could easily be financed by raising the taxes on the wealthy, including the introduction of a Financial Transaction Tax (FTT) that nets the banks and other "fat cat" financial speculators that distort the NZ economy," says Gunson.

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks turfing "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand.

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand, with public meetings held throughout the country, so that grassroots people can tell their stories.

For more comment, contact:

Vaughan Gunson

Bad Banks campaign manager

(09)433 8897

021-0415 082

svpl@xtra.co.nz

-----------------------------------------------------

Backgrounder:

Anger at Kiwibank closures

from Sunday Star Times

20 December 2009

Kiwibank - the brand that brought local banking back into fashion - is axing more than 20 of its branches, angering customers who bought into its patriotism-based advertising.

The closures come as Kiwibank instigator, Jim Anderton, credits the bank with reversing a trend towards shutting small branches.

David Tripe, director of Massey University's Centre for Banking Studies, said Kiwibank was undermining its own public relations pitch. "Essentially they're looking to close branches for the same reason as all the other banks closed them in the 1990s."

Since launching in 2002, Kiwibank has attracted 650,000 customers. Its advertising uses World War II-era imagery to push a theme of resistance to foreign invaders - the overseas-owned banks, which shut more than 1300 New Zealand branches in the 1980s and 1990s.

Since January, Kiwibank's owner, New Zealand Post, has either shut, or announced plans to shut, at least 20 of its about 300 branches, prompting public meetings, petitions and demonstrations.

Kiwibank exists in two forms: either as a franchise, typically run by a small business owner out of a dairy or stationery shop, or as part of a corporate branch of NZ Post. In some cases, NZ Post has shut a Kiwibank franchise and directed customers to one of its corporate branches. In others, where a franchisee has opted out, customers have received letters from New Zealand Post blaming the closure on the franchisee, but has not said if it has sought a replacement.

Kiwibank spokesman Bruce Thompson said two branches had opened in the past year. Another 29 had been upgraded or relocated, or both.

Anderton said Kiwibank's network was still the biggest of any bank operating in New Zealand. That included more than 30 towns and suburbs where there were no other banks.

Since Kiwibank opened, not a single overseas-owned bank had shut a branch in New Zealand. The closures were "what happens with a modern business".

Tripe said Kiwibank faced the same challenge as any other bank in making branches work - generating enough revenue to surpass running costs. In the case of the 20 closures, Kiwibank had responded no differently to the major banks.

KIWIBANKS AXED

(Including closures of actual buildings, as well as downgrades of PostShops offering Kiwibank and bill payment services.)

Mahora, Hastings

Glendene, Auckland

Te Puni, Lower Hutt

Henderson, Auckland

Braid Rd, St Andrews, Hamilton

H&J Smith, Invercargill

Balmoral, Auckland

Sandringham, Auckland

Papatoetoe South, Auckland

Greenwoods Corner, Auckland

Redwood Downs, Christchurch

Onekawa, Napier

Beckenham, Christchurch

Hereford St, Christchurch

Waimairi Rd, Ilam, Christchurch

Hokowhitu, Palmerston North

Awapuni, Palmerston

North Books and More, High St, Lower Hutt

Linwood, Christchurch

20 December 2009

An article in the Sunday Star Times, Anger at Kiwibank closures (20 Dec 2009), outlines plans by Kiwibank to close 20 branches nationwide. A cost saving initiative by the bank.

"This decision by Kiwibank bosses shows that when it comes to maintaining its "bottom line" there's not much difference between Kiwibank and the other banks, " says Vaughan Gunson, Bad Banks campaign manager.

"Kiwibank has tried to market its difference to the Aussie banks (ANZ National, BNZ, Westpac and ASB) who dominate the banking industry in New Zealand, but the reality is simply that Kiwibank currently doesn't offer much of an alternative," says Gunson. "That's because Kiwibank was founded by the government in 2002 to operate as a business, one that has to compete "fairly" with other banks, and at the same time deliver a return to the government."

The comment in the Sunday Star Times article by Jim Anderton, leader of the Progressive Party and proponent of Kiwibank, reveals the limits of the market model that Kiwibank operates under. Anderton justified the closures on the grounds that this is "what happens with a modern business".

"Anderton is right," says Gunson, "a modern business serves its own purpose, not the wider needs of the community. This is the whole problem with the banking sector in this country and internationally".

"The financial implosion that almost brought down the global economy last year, and which is continuing to wreck havoc on the lives of grassroots people, shows that we need to urgently rein in the power of the banks, " says Gunson. "Turning Kiwibank into a proper public bank would be a good start."

"A proper public bank", says Gunson, "could offer 3% state loans to first home buyers and zero-fee banking to low and middle income people. Such bold and sensible initiatives would transform banking in this country."

"Public service banking could easily be financed by raising the taxes on the wealthy, including the introduction of a Financial Transaction Tax (FTT) that nets the banks and other "fat cat" financial speculators that distort the NZ economy," says Gunson.

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks turfing "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand.

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand, with public meetings held throughout the country, so that grassroots people can tell their stories.

For more comment, contact:

Vaughan Gunson

Bad Banks campaign manager

(09)433 8897

021-0415 082

svpl@xtra.co.nz

-----------------------------------------------------

Backgrounder:

Anger at Kiwibank closures

from Sunday Star Times

20 December 2009

Kiwibank - the brand that brought local banking back into fashion - is axing more than 20 of its branches, angering customers who bought into its patriotism-based advertising.

The closures come as Kiwibank instigator, Jim Anderton, credits the bank with reversing a trend towards shutting small branches.

David Tripe, director of Massey University's Centre for Banking Studies, said Kiwibank was undermining its own public relations pitch. "Essentially they're looking to close branches for the same reason as all the other banks closed them in the 1990s."

Since launching in 2002, Kiwibank has attracted 650,000 customers. Its advertising uses World War II-era imagery to push a theme of resistance to foreign invaders - the overseas-owned banks, which shut more than 1300 New Zealand branches in the 1980s and 1990s.

Since January, Kiwibank's owner, New Zealand Post, has either shut, or announced plans to shut, at least 20 of its about 300 branches, prompting public meetings, petitions and demonstrations.

Kiwibank exists in two forms: either as a franchise, typically run by a small business owner out of a dairy or stationery shop, or as part of a corporate branch of NZ Post. In some cases, NZ Post has shut a Kiwibank franchise and directed customers to one of its corporate branches. In others, where a franchisee has opted out, customers have received letters from New Zealand Post blaming the closure on the franchisee, but has not said if it has sought a replacement.

Kiwibank spokesman Bruce Thompson said two branches had opened in the past year. Another 29 had been upgraded or relocated, or both.

Anderton said Kiwibank's network was still the biggest of any bank operating in New Zealand. That included more than 30 towns and suburbs where there were no other banks.

Since Kiwibank opened, not a single overseas-owned bank had shut a branch in New Zealand. The closures were "what happens with a modern business".

Tripe said Kiwibank faced the same challenge as any other bank in making branches work - generating enough revenue to surpass running costs. In the case of the 20 closures, Kiwibank had responded no differently to the major banks.

KIWIBANKS AXED

(Including closures of actual buildings, as well as downgrades of PostShops offering Kiwibank and bill payment services.)

Mahora, Hastings

Glendene, Auckland

Te Puni, Lower Hutt

Henderson, Auckland

Braid Rd, St Andrews, Hamilton

H&J Smith, Invercargill

Balmoral, Auckland

Sandringham, Auckland

Papatoetoe South, Auckland

Greenwoods Corner, Auckland

Redwood Downs, Christchurch

Onekawa, Napier

Beckenham, Christchurch

Hereford St, Christchurch

Waimairi Rd, Ilam, Christchurch

Hokowhitu, Palmerston North

Awapuni, Palmerston

North Books and More, High St, Lower Hutt

Linwood, Christchurch

No easing of mortgagee sales predicted

20 December 2009

Source: NZPA

The number of people losing their homes to a mortgagee sale may have dipped according to the most recent data but numbers are still expected to remain high into the New Year.

Figures from land information company Terralink International show there were 298 registered mortgagee sales during October down 45 from September but still well above the 174 recorded in October 2008.

While the October figures showed a decline Terralink managing director Mike Donald expected numbers to remain high for a while yet.

"It's a mistake to think that a decrease this month means that mortgagee sales are set to return to pre-recession levels. There's a slight easing in October but when you look at the whole picture you'll see the numbers remain at an all time high. It's still a volatile situation and the numbers of mortgagee sales we have been seeing shows the length of time it takes to work through the financial stress of the recession."

The percentage of mortgagee sales from individual homeowners with only one property had been climbing, Mr Donald said.

"These are the people who we'd probably think of as the `Mum and Dad' homeowners. They now make up nearly one in four of the total mortgagee sales in New Zealand, or 24%.

"As the year has gone on, and spending has decreased, and redundancies have increased more and more ordinary New Zealanders have been affected by the recession. Forced sales of their homes has unfortunately been a consequence for some," Mr Donald said.

Regions hardest hit in October were Auckland and Waikato while Otago, Southland and Taranaki all experienced increases.

Mortgagee sales accounted for almost 5 percent of the total nationwide property sales in October.

Source: NZPA

The number of people losing their homes to a mortgagee sale may have dipped according to the most recent data but numbers are still expected to remain high into the New Year.

Figures from land information company Terralink International show there were 298 registered mortgagee sales during October down 45 from September but still well above the 174 recorded in October 2008.

While the October figures showed a decline Terralink managing director Mike Donald expected numbers to remain high for a while yet.

"It's a mistake to think that a decrease this month means that mortgagee sales are set to return to pre-recession levels. There's a slight easing in October but when you look at the whole picture you'll see the numbers remain at an all time high. It's still a volatile situation and the numbers of mortgagee sales we have been seeing shows the length of time it takes to work through the financial stress of the recession."

The percentage of mortgagee sales from individual homeowners with only one property had been climbing, Mr Donald said.

"These are the people who we'd probably think of as the `Mum and Dad' homeowners. They now make up nearly one in four of the total mortgagee sales in New Zealand, or 24%.

"As the year has gone on, and spending has decreased, and redundancies have increased more and more ordinary New Zealanders have been affected by the recession. Forced sales of their homes has unfortunately been a consequence for some," Mr Donald said.

Regions hardest hit in October were Auckland and Waikato while Otago, Southland and Taranaki all experienced increases.

Mortgagee sales accounted for almost 5 percent of the total nationwide property sales in October.

19.12.09

Kiwibank needs to be turned into a proper public bank

The article in the Sunday Star Times, Anger at Kiwibank closures (20 Dec 2009), outlines plans by Kiwibank to close 20 branches nationwide. A cost saving initiative by the bank.

While Kiwibank has tried to market its difference to the Australian owned banks who dominate the banking industry in New Zealand, the reality is that Kiwibank currently doesn't offer much of an alternative. That's because Kiwibank was founded by the government in 2002 to operate as a business, one that has to compete "fairly" with other banks, and at the same time deliver a profit to the government.

The comment in the Sunday Star Time article by Jim Anderton, leader of the Progressive Party and proponent of Kiwibank, reveals the limits of the market model of banking that Kiwibank operates under. Anderton justified the closures on the grounds that this is "what happens with a modern business".

The Bad Banks campaign advocates turning Kiwibank into a proper public bank, as part of major reform of banking in New Zealand. Kiwibank should offer 3% state loans to first home buyers and zero-fee banking to low and middle income people.

This could be financed by raising taxes on the rich, including the introduction of a Financial Transaction Tax (FTT) that nets the banks and other "fat cat" financial speculators that distort the NZ economy.

See Make Kiwibank Public.

12.12.09

Naughty banks need more than a slap on the wrist

by Matt McCarten

from NZ Herald

13 December 2009

The Australian banks last week had their Prime Minister scolding them to take a hard look at themselves. That's because they snuck through an interest rate rise after their Reserve Bank raised its rates.

Westpac was the worst with a 45-point hike, even though the Reserve Bank raised the rate by only 25 points.

Westpac rubbed salt into its customers' wounds by sending them an email comparing the bank's profit-gouging decision to a situation when a tropical storm hits a banana plantation. Apparently, such an occurrence would increase the price of a banana smoothie.

Of course, the comparison was dishonest and patronising.

A bank's unethical profiteering that puts people in a situation of not being able to pay their mortgage is outrageous enough. But comparing it with paying more for a banana smoothie has caused a furore in Australia.

Westpac won't want that public relations disaster following it over here, given it has announced it is making over its New Zealand brand to show how much it cares about us.

The other Australian banks (ANZ, ASB, BNZ and National) have followed with a charm offensive, too. There are lots of soothing words about how they want to get closer to New Zealanders by opening more branch offices and offering more intimate services.

It's a bit hard to understand their strategy, given they recently sacked hundreds of Kiwi bank tellers and shipped their work offshore to call-centre factories. It seems only yesterday we were being told local bank branch closures would save us money.

Despite those rather inconvenient truths, the public relations campaign to win our goodwill is well under way. Recently, BNZ proudly promoted its public spirit credentials by closing its doors for a day and paying its employees to do community work for the day.

I'm not trying to piss on the parade, but the day after, I was in a BNZ bank and the staff were running ragged. One of them dryly noted that BNZ got good publicity, but it also meant the workers had to fit five days' work into four days that week.

One of the BNZ's main competitors, the ASB Bank, is now rebranded as the "caring bank". It also claims to have been a "Kiwi bank since 1847".

I doubt the Commonwealth Bank of Australia is aware of the new change of ownership.

It seems that the new initiatives to win our favour are twofold. Despite the widespread political opposition and scepticism to setting up a publicly owned community, Kiwibank has gone from strength to strength as many New Zealanders have swapped their bank accounts over. Nationalism and sovereignty are strong emotions.

The second reason is the public mood is going dog on them. There's been too much news about interest fixing, exorbitant fees and the outrageous tax evasion cases now before the courts.

That's on top of the increasing numbers of ordinary New Zealanders losing their homes as the banks start foreclosing on them.

Vaughan Gunson from the Bad Bank campaign claims the Australian bank owners are terrified that the public sentiments will lead to politicians on both sides of the Tasman following their American colleagues and regulating the industry to curb its excessive profiteering. Gunson blames the banks for causing the financial crisis that almost collapsed the global economy.

The Bad Bank supporters picketed a bank in downtown Auckland on Friday as part of their campaign to force the Government to hold a formal inquiry into the role of banks in this country.

Westpac ran a stupid banana campaign, says Gunson, but the whole world banking system has gone bananas. One slip on a skin and we're all gone.

The Government's siding with the Australian bank owners in not holding an inquiry makes me nervous.

from NZ Herald

13 December 2009

The Australian banks last week had their Prime Minister scolding them to take a hard look at themselves. That's because they snuck through an interest rate rise after their Reserve Bank raised its rates.

Westpac was the worst with a 45-point hike, even though the Reserve Bank raised the rate by only 25 points.

Westpac rubbed salt into its customers' wounds by sending them an email comparing the bank's profit-gouging decision to a situation when a tropical storm hits a banana plantation. Apparently, such an occurrence would increase the price of a banana smoothie.

Of course, the comparison was dishonest and patronising.

A bank's unethical profiteering that puts people in a situation of not being able to pay their mortgage is outrageous enough. But comparing it with paying more for a banana smoothie has caused a furore in Australia.

Westpac won't want that public relations disaster following it over here, given it has announced it is making over its New Zealand brand to show how much it cares about us.

The other Australian banks (ANZ, ASB, BNZ and National) have followed with a charm offensive, too. There are lots of soothing words about how they want to get closer to New Zealanders by opening more branch offices and offering more intimate services.

It's a bit hard to understand their strategy, given they recently sacked hundreds of Kiwi bank tellers and shipped their work offshore to call-centre factories. It seems only yesterday we were being told local bank branch closures would save us money.

Despite those rather inconvenient truths, the public relations campaign to win our goodwill is well under way. Recently, BNZ proudly promoted its public spirit credentials by closing its doors for a day and paying its employees to do community work for the day.

I'm not trying to piss on the parade, but the day after, I was in a BNZ bank and the staff were running ragged. One of them dryly noted that BNZ got good publicity, but it also meant the workers had to fit five days' work into four days that week.

One of the BNZ's main competitors, the ASB Bank, is now rebranded as the "caring bank". It also claims to have been a "Kiwi bank since 1847".

I doubt the Commonwealth Bank of Australia is aware of the new change of ownership.

It seems that the new initiatives to win our favour are twofold. Despite the widespread political opposition and scepticism to setting up a publicly owned community, Kiwibank has gone from strength to strength as many New Zealanders have swapped their bank accounts over. Nationalism and sovereignty are strong emotions.

The second reason is the public mood is going dog on them. There's been too much news about interest fixing, exorbitant fees and the outrageous tax evasion cases now before the courts.

That's on top of the increasing numbers of ordinary New Zealanders losing their homes as the banks start foreclosing on them.

Vaughan Gunson from the Bad Bank campaign claims the Australian bank owners are terrified that the public sentiments will lead to politicians on both sides of the Tasman following their American colleagues and regulating the industry to curb its excessive profiteering. Gunson blames the banks for causing the financial crisis that almost collapsed the global economy.

The Bad Bank supporters picketed a bank in downtown Auckland on Friday as part of their campaign to force the Government to hold a formal inquiry into the role of banks in this country.

Westpac ran a stupid banana campaign, says Gunson, but the whole world banking system has gone bananas. One slip on a skin and we're all gone.

The Government's siding with the Australian bank owners in not holding an inquiry makes me nervous.

ANZ's intricate tax dodging continues

In an article that appeared in the Sunday Star Times, ANZ in intricate deal on eve of court battle (13 Dec), reporter Rob Stock details how ANZ (but not just not them) used shonky loan deals with foreign banks labelled "money go rounds" to avoid tax.

Rob Stock gives examples of one particular money go round set up within New Zealand:

Rob Stock gives examples of one particular money go round set up within New Zealand:

The BNP Paribas transaction is not the only curious-looking structure on ANZ National Bank's books. There are several related-party loan deals that have a similar appearance to tax dodging money-go-rounds.

Cortland Finance, for example, was owed $437m by ANZ National Bank at the end of September 2008, though it is a wholly owned subsidiary of Arawata Finance, which is 100% owned by ANZ National Bank. In other words, ANZ had put capital into the company and then borrowed it back again.

Similarly, ANZ National Bank owes more than $2b to its wholly owned subsidiaries Tui Finance and Tui Endeavour, money that represents capital put in by the bank. Also at the end of September 2008, Arawata Finance was owed $717m by ANZ National Bank, but it owed the bank $533m.

10.12.09

"It's the whole banking system which is bananas", say Bad Banks campaigners

Bad Banks media release

10 December 2009

Australian prime minister Kevin Rudd has just given a very public serve to Westpac for an email the bank sent to mortgage customers featuring a cartoon video about selling bananas to justify a big hike in its mortgage rates. (See Westpac goes bananas - http://www.news.com.au/couriermail/story/0,,26462786-3122,00.html.)

"This is just another example of the silly tricks that the Big Four Australian-owned banks (ANZ National, BNZ, Westpac and ASB) are pulling to try and "win over" the public", says Vaughan Gunson, Bad Banks campaign spokesperson.

In New Zealand, BNZ closed the doors of its branches and instructed staff to do community work for a day. And ASB Bank has been pushing an advertising campaign which tries to paint a picture of a "caring bank" that serves us.

"ASB have made the ridiculous claim that they've been a "Kiwi bank since 1847", when in fact they're fully owned by Commonwealth Bank of Australia", says Gunson.

"The banks are trying to "suck up" because they know there's a bad public mood against them, as a result of their interest gouging, fee charging, and tax dodging", says Gunson. "Many New Zealand homeowners are experiencing mortgage stress, thanks to the banks."

"What the Aussie banks are worried about is that the public mood against them will put pressure on governments on both sides of the Tasman to put in place tough regulations that curb their power and rein in their profits", says Gunson.

The Bad Banks campaign is doing its bit to keep the pressure on the banks. Tomorrow (Friday) at 12noon we're going to be outside ASB's Queen Street branch (cnr Wellesley St) with placards and a new leaflet exposing ASB.

"Our aim is to promote a nationwide and popular debate on the banks and their role in the economy", says Gunson. "It goes way beyond a few bad banks, we think the whole banking system is bananas."

"The financial implosion that almost brought down the global economy last year, and which is continuing to wreck havoc on the lives of grassroots people, shows that we need to urgently bring the banks under control", says Gunson.

There is momentum building even amongst the global financial elite for more regulation and control to be imposed on the banks. (See Ex-Fed chief Paul Volcker's 'telling' words on derivatives industry - http://www.telegraph.co.uk/finance/economics/6764177/Ex-Fed-chief-Paul-Volckers-telling-words-on-derivatives-industry.html.)

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks turfing "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand.

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand, with public meetings held throughout the country, so that grassroots people can tell their stories.

Contact:

Vaughan Gunson

Bad Banks media spokesperson

(09)433 8897

021-0415 082

svpl@xtra.co.nz

10 December 2009

Australian prime minister Kevin Rudd has just given a very public serve to Westpac for an email the bank sent to mortgage customers featuring a cartoon video about selling bananas to justify a big hike in its mortgage rates. (See Westpac goes bananas - http://www.news.com.au/couriermail/story/0,,26462786-3122,00.html.)

"This is just another example of the silly tricks that the Big Four Australian-owned banks (ANZ National, BNZ, Westpac and ASB) are pulling to try and "win over" the public", says Vaughan Gunson, Bad Banks campaign spokesperson.

In New Zealand, BNZ closed the doors of its branches and instructed staff to do community work for a day. And ASB Bank has been pushing an advertising campaign which tries to paint a picture of a "caring bank" that serves us.

"ASB have made the ridiculous claim that they've been a "Kiwi bank since 1847", when in fact they're fully owned by Commonwealth Bank of Australia", says Gunson.

"The banks are trying to "suck up" because they know there's a bad public mood against them, as a result of their interest gouging, fee charging, and tax dodging", says Gunson. "Many New Zealand homeowners are experiencing mortgage stress, thanks to the banks."

"What the Aussie banks are worried about is that the public mood against them will put pressure on governments on both sides of the Tasman to put in place tough regulations that curb their power and rein in their profits", says Gunson.

The Bad Banks campaign is doing its bit to keep the pressure on the banks. Tomorrow (Friday) at 12noon we're going to be outside ASB's Queen Street branch (cnr Wellesley St) with placards and a new leaflet exposing ASB.

"Our aim is to promote a nationwide and popular debate on the banks and their role in the economy", says Gunson. "It goes way beyond a few bad banks, we think the whole banking system is bananas."

"The financial implosion that almost brought down the global economy last year, and which is continuing to wreck havoc on the lives of grassroots people, shows that we need to urgently bring the banks under control", says Gunson.

There is momentum building even amongst the global financial elite for more regulation and control to be imposed on the banks. (See Ex-Fed chief Paul Volcker's 'telling' words on derivatives industry - http://www.telegraph.co.uk/finance/economics/6764177/Ex-Fed-chief-Paul-Volckers-telling-words-on-derivatives-industry.html.)

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks turfing "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand.

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand, with public meetings held throughout the country, so that grassroots people can tell their stories.

Contact:

Vaughan Gunson

Bad Banks media spokesperson

(09)433 8897

021-0415 082

svpl@xtra.co.nz

Bad Banks exposure of ASB's "Kiwi bank" claim - 12noon, Friday 11 December

Bad Banks media release

7 December 2009

http://www.badbanks.co.nz/

Bad Banks campaigners will be outside ASB Bank on Queen Street (cnr Wellesley St), Auckland, this Friday to expose ASB's claim that it's a "Kiwi bank".

"ASB ain't no Kiwi bank," says Vaughan Gunson, Bad Banks media spokesperson. "They're 100% owned by the Commonwealth Bank of Australia, one of the bigger banks in the world. They're misleading the New Zealand public, to say the least."

"We find their recent advertising campaign hard to stomach, and I'm sure many people feel the same," says Gunson, "because ASB and the other Aussie-owned banks (ANZ National, BNZ, and Westpac) aren't serving our interests at all. Their only goal is to make as much money as possible for bank bosses and corporate shareholders."

"The Aussie-owned banks have been making exorbitant profits for years from high interest rates on mortgages and credit cards, as well as imposing high fees and late penalties. They've been hurting grassroots New Zealanders," says Gunson.

"And now with the recession and people struggling to pay the bills, the banks are out to protect their own equity position by forcing mortgagee sales in record numbers," says Gunson.

On top of these injustices, ASB is refusing to pay an unpaid tax bill of $285 million. "Rather than big-budget advertising campaigns designed to mislead us, ASB bosses should just pay up the tax they owe," says Gunson.

"It's obvious that ASB and the other big banks are trying to suck up to us. Why? Because they're worried that the bad public mood against them will result in the government being forced to curb banking power and rein in their profits. Which is exactly what the Bad Banks campaign wants to see, " says Gunson.

"We've started a long term campaign to build pressure on the banks, which we hope will result in tougher regulations being placed on the banking and finance industries. Most people would say it can't happen too soon," says Gunson.

Bad Banks campaigners recently nominated ASB Bank for the 2009 Roger Award, given annually to the "Worst Transnational Corporation Operating in Aotearoa/New Zealand" (see Backgrounder #2 below).

"It was difficult to choose which bank to nominate for The Roger Award, because in the eyes of most New Zealanders all banks are bad," says Gunson. "But what tipped the balance in favour of ASB, was the fact that ASB bosses have been very hostile to the bank workers union, Finsec."

"Today, ASB is the only big bank which is not unionised. Which begs the question: is it "Kiwi" to be anti-union?" asks Gunson.

Bad Banks campaigners will be carrying placards, making some noise, and handing out leaflets to the public outside the Queen Street branch of ASB Bank at 12noon, this Friday, 11 December. Media are invited to attend to get more comment, plus photos/footage.

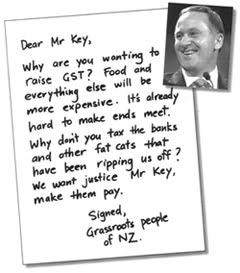

The cartoon image attached to this media release is by ex-NZ Herald cartoonist, KLARC. It is freely available for reproduction on websites or in print publications.

For more comment, contact:

Vaughan Gunson

Bad Banks media spokesperson

(09)433 8897

021-0415 082

svpl@xtra.co.nz

________________________________________

Backgrounder #1

The Bad Banks campaign has been initiated by Socialist Worker-New Zealand. We believe the banks in New Zealand and globally have grown to exercise enormous and dangerous power over the economy. The big banks and their government backers are driving forward economic policies that threaten people and planet.

There are a range of measures needed to stop the banks, from tough government regulations to establishing proper public banks which provide credit as a service rather than to make a profit.

The Bad Banks campaign also advocates measures like a Financial Transaction Tax (FTT) to net the banks and other financial speculators whose profits from wheeling and dealing goes largely untaxed. Such a tax would allow New Zealand to move towards a fairer tax system which shifts the tax burden off low and middle income people and onto the big wealthy corporates.

For more information on the Bad Banks campaign go to http://www.badbanks.co.nz/

Backgrounder #2

These were the 10 reasons given by Bad Banks campaigners for why ASB deserved to receive the 2009 Roger Award:

1. Interest gouging grassroots Kiwi homeowners.

Mortgage holders know it. Even the Reserve Bank in 2009 came out and said that the banks, including ASB, were keeping their interest rates too high. High interest rates on large mortgages put modest income earners under considerable financial stress in 2009, as many were affected by job losses, income cuts, and general financial insecurity. (See http://www.nzherald.co.nz/interest-rates/news/article.cfm?c_id=235&objectid=10582846)

2. Foreclosing on people's homes.

2009 saw record numbers of mortgagee sales, as banks moved to protect their own equity position by turfing increasing numbers of "mum and dad" mortgage holders out of their homes. Hundreds of homeowners were foreclosed in Auckland, ASB's home turf. (See http://business.scoop.co.nz/2009/09/28/record-high-for-mortgagee-sales-despite-recovery)

3. Continuing to make massive profits at the expense of grassroots people.

The recession of 2008/09 did not prevent ASB making a big profit, $238 million for the first six months of the financial year. Such a high profit in a recession points to the power the bank has to shift the burden of economic hard times on to ordinary New Zealanders. (See http://tvnz.co.nz/business-news/asb-tax-operating-profit-down-2477075)

4. Mega-scale tax dodging.

It came to public attention in 2009 the full extent of tax dodging by the Big Four Aussie-owned banks, over $2 billion. The IRD is after $285 million from ASB for unpaid tax between 2001 and 2004. Having been caught, ASB bosses are still refusing to pay up, and will likely use teams of expensive lawyers to drag the process through the courts, costing the IRD and the Crown millions. (See http://www.nbr.co.nz/article/asb-estimates-285-million-exposure-nz-tax-case-113373)

5. Failing to face up to public scrutiny.

Nobody from ASB Bank fronted up to the parliamentary inquiry into the operations of the banks organised by the Green, Labour and Progressive parties in 2009. While this inquiry had no teeth, because it was not supported by the National government, this disregard for the New Zealand public showed how arrogant and conceited is the position of the Aussie-owned banks. (See http://www.scoop.co.nz/stories/PA0909/S00049.htm)

6. Union busting.

The ASB Bank has determinedly used anti-union practices to stop Finsec Union from organising bank workers. To inquire more about ASB's union busting you could contact Finsec Union directly, phone 04 385 7723, email union@finsec.org.nz.

7. Imposing a wage freeze on workers.

All ASB Bank employees earning over $50,000 have been informed this year that they will be subject to a wage freeze. This will affect 3,500 of the bank's 4,700 staff nationwide. The low bar compares unfavourably with that being used by ASB's parent company in Australia, Commonwealth Bank, where the wage freeze is for staff earning over $100,000. (See http://finsec.wordpress.com/2009/04/24/asb-bank-freeze-staff-wages-%E2%80%93-no-union-members-to-stop-it/)

8. Deceiving New Zealanders by claiming to be a "Kiwi Bank".

ASB advertisements in October 2009 used the phrase "we've been a KIWI BANK since 1847", when in fact ASB is almost entirely Aussie owned. The phrase cynically seeks to convey the impression that the ASB Bank operates in the interests of New Zealanders, when its corporate practices plainly tell another story. (See http://www.nzherald.co.nz/sideswipe/news/article.cfm?c_id=702&objectid=10604600)

9. Cutting funding to community groups.

Just when many community organisations needed it most, to deal with the human fallout of the recession, ASB Bank, through its ASB Charitable Trust, froze grants for six months in 2009. This is despite continuing to make big profits. (See http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10603631)

10. Using the media to frame public debate in a way that's advantageous to banks.

Any search of news websites like NZ Herald or Stuff for "ASB" reveals just how often spokespeople for the bank are in the media. The bank produced a constant stream of statements and commentary on economic indicators, which are clearly designed to frame media debate on economic issues in a way that's favorable to banking operations.

For more information on CAFCA (Campaign Against Foreign Control of Aotearoa) and The Roger Award go to http://canterbury.cyberplace.co.nz/community/CAFCA/

(Note ASB was not one of The Roger Award finalists recently announced by CAFCA)

7 December 2009

http://www.badbanks.co.nz/

Bad Banks campaigners will be outside ASB Bank on Queen Street (cnr Wellesley St), Auckland, this Friday to expose ASB's claim that it's a "Kiwi bank".

"ASB ain't no Kiwi bank," says Vaughan Gunson, Bad Banks media spokesperson. "They're 100% owned by the Commonwealth Bank of Australia, one of the bigger banks in the world. They're misleading the New Zealand public, to say the least."

"We find their recent advertising campaign hard to stomach, and I'm sure many people feel the same," says Gunson, "because ASB and the other Aussie-owned banks (ANZ National, BNZ, and Westpac) aren't serving our interests at all. Their only goal is to make as much money as possible for bank bosses and corporate shareholders."

"The Aussie-owned banks have been making exorbitant profits for years from high interest rates on mortgages and credit cards, as well as imposing high fees and late penalties. They've been hurting grassroots New Zealanders," says Gunson.

"And now with the recession and people struggling to pay the bills, the banks are out to protect their own equity position by forcing mortgagee sales in record numbers," says Gunson.

On top of these injustices, ASB is refusing to pay an unpaid tax bill of $285 million. "Rather than big-budget advertising campaigns designed to mislead us, ASB bosses should just pay up the tax they owe," says Gunson.

"It's obvious that ASB and the other big banks are trying to suck up to us. Why? Because they're worried that the bad public mood against them will result in the government being forced to curb banking power and rein in their profits. Which is exactly what the Bad Banks campaign wants to see, " says Gunson.

"We've started a long term campaign to build pressure on the banks, which we hope will result in tougher regulations being placed on the banking and finance industries. Most people would say it can't happen too soon," says Gunson.

Bad Banks campaigners recently nominated ASB Bank for the 2009 Roger Award, given annually to the "Worst Transnational Corporation Operating in Aotearoa/New Zealand" (see Backgrounder #2 below).

"It was difficult to choose which bank to nominate for The Roger Award, because in the eyes of most New Zealanders all banks are bad," says Gunson. "But what tipped the balance in favour of ASB, was the fact that ASB bosses have been very hostile to the bank workers union, Finsec."

"Today, ASB is the only big bank which is not unionised. Which begs the question: is it "Kiwi" to be anti-union?" asks Gunson.

Bad Banks campaigners will be carrying placards, making some noise, and handing out leaflets to the public outside the Queen Street branch of ASB Bank at 12noon, this Friday, 11 December. Media are invited to attend to get more comment, plus photos/footage.

The cartoon image attached to this media release is by ex-NZ Herald cartoonist, KLARC. It is freely available for reproduction on websites or in print publications.

For more comment, contact:

Vaughan Gunson

Bad Banks media spokesperson

(09)433 8897

021-0415 082

svpl@xtra.co.nz

________________________________________

Backgrounder #1

The Bad Banks campaign has been initiated by Socialist Worker-New Zealand. We believe the banks in New Zealand and globally have grown to exercise enormous and dangerous power over the economy. The big banks and their government backers are driving forward economic policies that threaten people and planet.

There are a range of measures needed to stop the banks, from tough government regulations to establishing proper public banks which provide credit as a service rather than to make a profit.

The Bad Banks campaign also advocates measures like a Financial Transaction Tax (FTT) to net the banks and other financial speculators whose profits from wheeling and dealing goes largely untaxed. Such a tax would allow New Zealand to move towards a fairer tax system which shifts the tax burden off low and middle income people and onto the big wealthy corporates.

For more information on the Bad Banks campaign go to http://www.badbanks.co.nz/

Backgrounder #2

These were the 10 reasons given by Bad Banks campaigners for why ASB deserved to receive the 2009 Roger Award:

1. Interest gouging grassroots Kiwi homeowners.

Mortgage holders know it. Even the Reserve Bank in 2009 came out and said that the banks, including ASB, were keeping their interest rates too high. High interest rates on large mortgages put modest income earners under considerable financial stress in 2009, as many were affected by job losses, income cuts, and general financial insecurity. (See http://www.nzherald.co.nz/interest-rates/news/article.cfm?c_id=235&objectid=10582846)

2. Foreclosing on people's homes.

2009 saw record numbers of mortgagee sales, as banks moved to protect their own equity position by turfing increasing numbers of "mum and dad" mortgage holders out of their homes. Hundreds of homeowners were foreclosed in Auckland, ASB's home turf. (See http://business.scoop.co.nz/2009/09/28/record-high-for-mortgagee-sales-despite-recovery)

3. Continuing to make massive profits at the expense of grassroots people.

The recession of 2008/09 did not prevent ASB making a big profit, $238 million for the first six months of the financial year. Such a high profit in a recession points to the power the bank has to shift the burden of economic hard times on to ordinary New Zealanders. (See http://tvnz.co.nz/business-news/asb-tax-operating-profit-down-2477075)

4. Mega-scale tax dodging.

It came to public attention in 2009 the full extent of tax dodging by the Big Four Aussie-owned banks, over $2 billion. The IRD is after $285 million from ASB for unpaid tax between 2001 and 2004. Having been caught, ASB bosses are still refusing to pay up, and will likely use teams of expensive lawyers to drag the process through the courts, costing the IRD and the Crown millions. (See http://www.nbr.co.nz/article/asb-estimates-285-million-exposure-nz-tax-case-113373)

5. Failing to face up to public scrutiny.

Nobody from ASB Bank fronted up to the parliamentary inquiry into the operations of the banks organised by the Green, Labour and Progressive parties in 2009. While this inquiry had no teeth, because it was not supported by the National government, this disregard for the New Zealand public showed how arrogant and conceited is the position of the Aussie-owned banks. (See http://www.scoop.co.nz/stories/PA0909/S00049.htm)

6. Union busting.

The ASB Bank has determinedly used anti-union practices to stop Finsec Union from organising bank workers. To inquire more about ASB's union busting you could contact Finsec Union directly, phone 04 385 7723, email union@finsec.org.nz.

7. Imposing a wage freeze on workers.

All ASB Bank employees earning over $50,000 have been informed this year that they will be subject to a wage freeze. This will affect 3,500 of the bank's 4,700 staff nationwide. The low bar compares unfavourably with that being used by ASB's parent company in Australia, Commonwealth Bank, where the wage freeze is for staff earning over $100,000. (See http://finsec.wordpress.com/2009/04/24/asb-bank-freeze-staff-wages-%E2%80%93-no-union-members-to-stop-it/)

8. Deceiving New Zealanders by claiming to be a "Kiwi Bank".