13 May 2010

Prominent New Zealand activists and unionists are among the 53 public signatories to a letter to prime minister John Key calling for action to curb banking power and protect grassroots people. The full list of public signatories is included below.

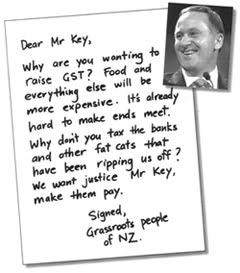

The letter, written on behalf of grassroots people in New Zealand, reads:

Dear Mr Key,

Why are you wanting to raise GST? Food and everything else will be more expensive. It's already hard to make ends meet. Why don't you tax the banks and other fat cats that have been ripping us off? We want justice Mr Key, make them pay.

Signed,

Grassroots people of NZ

“The global financial crisis has inflicted a lot of pain on New Zealanders, with job losses and widespread clamps on wages,” says Vaughan Gunson, Bad Banks spokesperson. “And this pain is being compounded by the Big Four Aussie banks looking after their own equity position. They’ve been forcing mortgagee sales and inflicting penalties on homeowners struggling to meet their mortgage payments.”

“We're sending a message to John Key and the government: it's the banks and other financial fats cats who must be made to pay, not grassroots New Zealanders," says Gunson.

With the letter Bad Banks campaigners are proposing three "common sense" measures that would rein in the banks and deliver real benefits to grassroots people. The three measures are:

1. Stop forced mortgagee sales

Regulatory muscle used to stop banks turfing people out of their homes. A government body to oversee the re-negotiation of mortgages based on current market values and ability of the homeowner to pay.

2. Turn Kiwibank into a proper public bank

Offering 3% interest loans to first home buyers, zero-fee banking for people on modest incomes, and low interest loans to local bodies for sustainable eco-projects in the public good.

3. Introduce a Robin Hood Tax (also known as a Financial Transaction Tax)

A small percentage tax on financial transactions would net billions of dollars from banks and global financial speculators. GST could be phased out.

“We’re inviting New Zealanders to sign on to the letter and support these three demands,” says Gunson. "They're doable, if there's the political will."

People can add their name online by visiting the Bad Banks website www.badbanks.co.nz, or by going directly to http://www.ipetitions.com/petition/badbanks/. People can also make a comment if they wish.

“In a month’s time we’ll be formally forwarding the letter and the full list of people who’ve signed, plus their comments, to the prime minister,” says Gunson.

“We would like to see a debate in New Zealand about why the government is planning to lift GST to 15% in the Budget on 20 May, while the big banks are being allowed to continue making their mega-profits,” says Gunson. “Bad Banks campaigners are up for the debate – is Mr Key?"

See also Bad Banks media release (25 April), Something missing from GST debate: a Robin Hood Tax.

A higher resolution image of the attached graphic for use in print and online publications is available.

For more information and comment, contact

Vaughan Gunson

Bad Banks spokesperson

svpl(at)xtra.co.nz

(09)433 8897

021-0415 082

The 53 public signatories to the letter to Mr Key and the accompanying proposals to rein in the banks and protect grassroots people are:

Moea Armstrong, co-convenor Green Party of Aotearoa/NZ, Whangarei.

James Barber, male co-convenor Greens@Vic, Wellington.

Potaua Biasiny-Tule, TangataWhenua.com, Rotorua.

Nikolasa Biasiny-Tule, TangataWhenua.com, Rotorua.

Victor Billot, communications officer Maritime Union, Dunedin.

Pat Bolster, secretary Unions Wellington.

Sue Bradford, community activist, Auckland.

Grant Brookes, union delegate, Wellington.

Paul Bruce, Greater Wellington Regional Councillor.

Andrew Campbell, union organiser, Wellington.

Joe Carolan, campaigns officer Unite Union & editor SocialistAotearoa.org

Laurence Clark, cartoonist & journalist, Whangarei.

David Colyer, editor UNITYblog, on-line journal of Socialist Worker-New Zealand.

Catherine Delahunty, Green Party List MP, Coromandel Peninsula.

Vincent Eastwood, Guerilla Media, Auckland.

Aaron Edwards, organiser Green Party, Whangarei.

Tony Fala, community worker, Manukau City.

Joe Fleetwood , general secretary Maritime Union of New Zealand, Wellington.

Quentin Findlay, economic development spokesperson Alliance Party, Christchurch.

Roger Fowler, manager Mangere East Community Learning Centre, Auckland.

Rob George, convenor Unions Waikato, Hamilton.

Vaughan Gunson, spokesperson Bad Banks & national chair Socialist Worker-New Zealand, Whangarei.

Omar Hamed, organiser Unite Union, Wellington.

Bernie Hornfeck, chairperson Rotorua Peoples’ Union.

Murray Horton, secretary/organiser for CAFCA (Campaign Against Foreign Control of Aotearoa), Christchurch.

Tim Howard, community worker, Whangarei.

Peter Hughes, union organiser, Auckland.

Prue Hyman, feminist economist Victoria University, Wellington.

Nik Janiurek, theatre lighting designer, Auckland.

Shafqat Kadri, student MA Applied Language Studies, University of Auckland.

Sydney Keepa, National Distribution Union Apiha Maori & co-convener Kaimahi Maori CTU Runanga,

Daphne Lawless, musician & writer, Auckland.

Dion Martin, organiser National Distribution Union, Palmerston North.

Paul Maunder, writer & community worker.

Matt McCarten, general secretary Unite Union, Auckland.

William (Billy) Mckee, director GreenCross NZ, Levin.

John Minto, community activist, Auckland.

Grant Morgan, international secretary Socialist Worker-New Zealand, Auckland.

Pat O'Dea, electrician & union activist, Auckland.

Hana el Ojeili, student LLB University of Auckland.

Dean Parker, NZ Writers' Guild, Auckland.

Len Parker, manager Socialist Centre, Auckland.

Kristy Pearson, student activist, Dunedin.

Paul Piesse, president Alliance Party, Christchurch.

Robert Popata, organiser Kotahitanga Union, Whangarei.

John Ryall, national secretary Service & Food Workers Union Nga Ringa Tota, Wellington.

Ross Scholes, Democracy activist, Auckland.

Tony Snelling-Berg, Socialist Worker activist, Tauranga.

Fran Strajnar, business owner, Auckland.

Owen Thompson, Unite Union, Auckland.

Mike Treen, national director Unite Union, Auckland.

Sarah Watson, writer & teacher, Wellington.

Oliver Woods, advertising manager, resident Singapore.

*All public signatories do so as individuals, with their positions or brief descriptors included for identification purposes.

**We welcome more community campaigners and prominent people becoming public signatories prior to the letter and accompanying demands being formally sent to the prime minister. Contact Vaughan, email svpl@xtra.co.nz or ph/txt 021-0415 082.