Bad Banks media release

24 December 2009

“It’s great news that the Aussie-owned banks have to pay up their unpaid tax,” says Vaughan Gunson, Bad Banks campaign manager. “It’s a defeat for them.” [See NZ Herald article Banks to pay taxman billions]

“It shows that big corporations can be brought into line. While the IRD had the law on its side, we shouldn’t underestimate the role mass public opinion has played in getting the banks to cough up,” says Gunson.

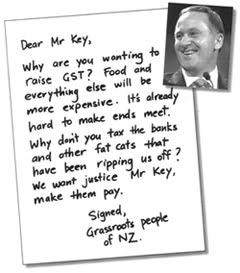

Bad Banks campaigners have been on the streets over the last few months handing out leaflets with information on the banks and the world economic crisis. “We’ve found there’s a real bad mood against the banks,” says Gunson.

“People know the Aussie banks have been making exorbitant profits over the last decade by charging high interest rates for mortgages and credit cards, high fees, and through mega-scale tax avoidance,” says Gunson.

People have been telling us, “Yes, the banks are bad”, “They’re ripping us off big time”, “The banks want to turn us all into debt slaves”.

“And there’s a high level of awareness that it’s the global banking cartels who are responsible for the world economic crisis which is causing large-scale job losses in New Zealand, along with widespread clamps on wages and salaries,” says Gunson.

“The banks and other corporates are trying to make ordinary working people bear the cost of the crisis. We need to resist,” says Gunson.

“To make the big banks and financial speculators pay we’re campaigning for the introduction of a Financial Transaction Tax. A small percentage tax on every financial transaction would net hundreds of millions from banks and international speculators who shift billions and billions of dollars around every year,” says Gunson.

“A tax that targets the mega-rich would allow us to shift the tax burden off low and middle income earners,” says Gunson. “We could take GST off food, which would be a big help to grassroots New Zealanders struggling to pay the bills.”

“Just because the banks have been forced to pay their unpaid tax bill, doesn’t mean they should be let of the hook,” says Gunson. “To protect our people we urgently need major reform of the banking industry.”

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks chucking "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand .

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand , with public meetings held throughout the country, so that grassroots people can tell their stories.

For more comment, contact:

Vaughan Gunson

Bad Banks campaign manager

(09)433 8897

021-0415 082

svpl@xtra.co.nz

See also the media release from CAFCA, IRD Delivers Best Possible Xmas Present To Long Suffering Kiwi Taxpayers.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment