by Paola Harvey

from Green Left Weekly (Australia)

30 January 2010

Although New Zealand, like Australia, has not been as badly affected by the global economic crisis as the US or Europe, workers are facing hardship.

Bronwen Beechey, an activist from Socialist Worker New Zealand (SWNZ), told Green Left Weekly: “There’ have been a lot of redundancies, places have been closed down.”

Beechey and SWNZ activist Peter Hughes were in Sydney to attend the January 3-6 Socialist Alliance national conference. They spoke to GLW about the SWNZ’s “bad banks” campaign, which takes aim at the cause of the global financial crisis — neoliberal capitalism.

“For people on low incomes life’s just been getting tougher because [they are] losing their jobs and food prices and rents and all of it have not come down substantially”, Beechey said.

“All the indicators, the social services, people asking for assistance, for food parcels, people losing their homes — they’ve all skyrocketed.”

Hughes said employers have used the crisis to justify attacking workers’ wages and conditions. “In the last 12 months, there have been no less than eight lockouts of workers.

“One of the most shameful examples was a service provider for the elderly that insisted that if the workers in that field did not accept the minimum wage [NZ$12.50 per hour] they’d be locked out.

“That’s quite a serious indication of how they [the bosses] see the crisis being resolved to their advantage and workers’ disadvantage.”

The New Zealand government’s response has been the same as capitalist governments around the world — bail out the banks and the big capitalists, and make the workers pay.

But they are not getting it all their own way. The government’s attempt to impose an unofficial wage freeze in the public service was recently challenged. Support staff in the education sector won a small wage rise.

That win will set the tone for the upcoming nurses’ and general education unions’ wage negotiations. “No less than that, will be the call, I’m sure”, said Hughes. “So that’s a good sign.

“I heard at the [Socialist Alliance] conference, that [Australian Prime Minister Kevin Rudd] said that the recovery’s going to be worse than the recession.

“I’m quite sure that’s their intention for us in New Zealand as well, working people will be made to pay for the recovery — if there’s going to be one.

“But our assessment is that there can be no real recovery in the current market economy, not in the foreseeable future. That’s going to lead to all sorts of crises for them, which they will try to push on us.

“We have to organise people to resist that.”

The discussion about neoliberalism at the NZ Council of Trade Unions’ 2009 conference has opened up more space on the left to fight back against these future crises.

At the conference, union activists talked about workers’ cooperatives, building and strengthening the union movement and not accepting the neoliberal capitalist model as the only option.

Beechey said: “It also talk[ed] about climate change and the need for an alternative economic strategy which is an implicit criticism of neoliberal capitalism.”

Hughes added: “While it’s not a policy position as such, it’s a discussion that’s been opened up within the trade union movement.

“It’s not an accepted policy, it could be watered down significantly and it’ll come down to how different unions interpret that for building a broader perspective in the membership.

“[But] when you think about how closely linked the trade union movement has been to the Labour Party … this is a departure.

“The fact that they’re daring to criticise publicly this position opens up a space on the left for us to work with trade union activists in a much more healthy and progressive way.”

Many people in New Zealand continue to struggle with little indication of their situation improving in the near future.

There has been an increase in the number of houses sold due to people defaulting on their home loans. A large proportion of these have been people with one home — not property speculators.

Hughes said the defaulters “simply cannot pay because they’ve lost their job, they’ve been made redundant and they have reduced incomes”.

“That’s pretty devastating for families and has shown no sign of abating at all.”

The actions of the banks have been completely shameful. Before the crisis, banks were advertising loans for 100% of the price of a house.

But after the crisis, their ruthless approach to lending has meant many people who were lured into the property market by these loans have had their home repossessed.

“Our campaign around ‘bad banks’ is trying to make them pay really”, said Hughes. “Because they’re the ones that have played a big role [in the crisis] and they’re plundering the profits of working people.”

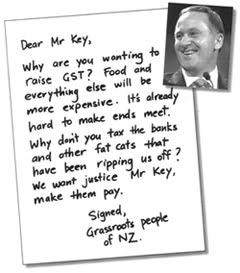

The bad banks campaign is focusing on demystifying what the banks actually do and how they caused the financial crisis. It is also calling for a financial transaction tax, as opposed to a goods and services tax.

A GST is a regressive tax, that is it affects the poorest the most, because the poor are taxed the same as the rich for goods despite having less ability to pay.

A financial transaction tax, on the other hand, would be a progressive tax. It would affect banks, corporations and the wealthy the most, because they account for the vast majority of financial transactions.

“We see the bad banks campaign as striking right to the heart of neo-liberalism”, Hughes said. “These banks have got their fingers in the lives of every working class person, whether it’s controlling their mortgage, their credit card, or their bank charges.

“They’re bloody pillaging basically. Their pockets are huge, they’re not paying their taxes.

“They’re not very popular with workers at the moment.”

11.1.10

Banksters and the greatest crime against humanity

The big global banks are key drivers of carbon emissions trading, which, as leading climate change scientist James Hanson argues, will increase carbon emissions, not decrease them. The role of the global banking class in sucking up trillions of dollars of "bailout money" to speculate in carbon trading (akin to derivatives trading) as the world approaches irreversible global warming tipping points has to be the greatest crime against humanity.

A necessary popular campaign against the banks is part of struggle to save the planet from the catastrophic climate change. See Bad Banks leaflet #3 on the pollution market.

A necessary popular campaign against the banks is part of struggle to save the planet from the catastrophic climate change. See Bad Banks leaflet #3 on the pollution market.

Leading Global Warming Crusader: Cap and Trade May INCREASE CO2 Emissions

by Washington's Blog

from Global Research

6 January 2010

James Hansen - the world's leading climate scientist fighting against global warming - told Amy Goodman this morning that cap and trade not only won't reduce emissions, it may actually increase them:

"The problem is that the emissions just go someplace else. That’s what happened after Kyoto, and that’s what would happen again, if—as long as fossil fuels are the cheapest energy, they will be burned someplace. You know, the Europeans thought they actually reduced their emissions after Kyoto, but what happened was the products that had been made in their countries began to be made in other countries, which were burning the cheapest form of fossil fuel, so the total emissions actually increased..."

Environmental groups such as Friends of the Earth and Greenpeace are also against cap and trade, as is the head of California's cap and trade program for the EPA.

Hansen also told Goodman that (notwithstanding Paul Krugman's assertions) most economists say that cap and trade won't work:

"I’ve talked with many economists, and the majority of them agree that the cap and trade with offsets is not the way to address the problem.

As I have previously pointed out:

- The economists who invented cap-and-trade say that it won't work for global warming

- European criminal investigators have determined that there is a tremendous amount of fraud occurring in the carbon trading market. Indeed, organized crime has largely taken over the European cap and trade market.

Our bailout buddies over at Goldman Sachs, JP Morgan, Morgan Stanley, Citigroup and the other Wall Street behemoths are buying heavily into carbon trading. As University of Maryland professor economics professor and former Chief Economist at the U.S. International Trade Commission Peter Morici writes:

- Former U.S. Undersecretary of Commerce for Economic Affairs Robert Shapiro says that the proposed cap and trade law "has no provisions to prevent insider trading by utilities and energy companies or a financial meltdown from speculators trading frantically in the permits and their derivatives."

"Obama must ensure that the banks use the trillions of dollars in federal bailout assistance to renegotiate mortgages and make new loans to worthy homebuyers and businesses. Obama must make certain that banks do not continue to squander federal largess by padding executive bonuses, acquiring other banks and pursuing new high-return, high-risk lines of businesses in merger activity, carbon trading and complex derivatives. Industry leaders like Citigroup have announced plans to move in those directions. Many of these bankers enjoyed influence in and contributed generously to the Obama campaign. Now it remains to be seen if a President Obama can stand up to these same bankers and persuade or compel them to act responsibly."

In other words, the same companies that made billions off of derivatives and other scams and are now getting bailed out on your dime are going to make billions from carbon trading.

One the largest boosters for cap and trade invented credit default swaps - which were supposed to increase financial stability, but instead were a large part of the reason that the world economy crashed last year.

Iceland: People power rises against financial overlords

The people of Iceland are saying no to having the cost of the financial crisis dumped on them. A quarter of Iceland's voters have signed a petition rejecting a deal which would see Iceland, through an IMF loan, pay billions to overseas creditors who lost money when the Icelandic banks went belly-up following the global financial crisis. The deal was the result of pressure from the British and Dutch governments in support of their banking class, who had a major hand in the high risk profiteering of Iceland's banks prior to the crisis.

While the situation in Iceland is at an extreme, it shows that it's possible for people to mobilise against the kings of capital and the governments that act to protect the interests of the mega-rich. With no real change in the way the big global banks and financial institutions are operating, and with the world economy having an ever increasing debt overhang, it is inevitable that more countries will be thrown into extreme economic and political crisis. In New Zealand, we need to prepare for such an event by building a broad and multi-headed campaign against the banks and neo-liberalism. To join the Bad Banks campaign email Vaughan svpl(at)xtra.co.nz

While the situation in Iceland is at an extreme, it shows that it's possible for people to mobilise against the kings of capital and the governments that act to protect the interests of the mega-rich. With no real change in the way the big global banks and financial institutions are operating, and with the world economy having an ever increasing debt overhang, it is inevitable that more countries will be thrown into extreme economic and political crisis. In New Zealand, we need to prepare for such an event by building a broad and multi-headed campaign against the banks and neo-liberalism. To join the Bad Banks campaign email Vaughan svpl(at)xtra.co.nz

Angry Iceland Defies the World

by Ambrose Evans-Pritchard

from Telegraph

6 January 2010

Iceland's president has blocked a Bill to pay Britain and Holland up to £3.4bn for Icesave depositors, acknowledging that popular feeling in the island nation is too strong to proceed without a referendum.

The move reopens a bitter dispute and greatly complicates Iceland's loan agreement with the International Monetary Fund. It has already led to a fresh downgrade to BB+ by Fitch Ratings, which called the decision "a significant setback to Iceland's efforts to restore normal financial relations with the rest of the world."

The Icesave law was passed by Iceland's parliament in a knife-edge vote late last year, but a petition by the InDefense movement has changed the political landscape. The lobby collected 56,000 signatures – a quarter of voters.

President Olafur Ragnar Grimsson said the "overwhelming majority" wanted a direct say over the matter, and that no settlement would hold without their assent.

"It is the cornerstone of the constitutional structure of the Republic of Iceland that the people are the supreme judge of the validity of the law," he said. "At this crucial juncture it is also important to emphasise that the recovery of the Icelandic economy is a matter of vital urgency".

If voters say "No" when the referendum takes place in a couple of months, the accord thrashed out with London and the Hague during months of wrangling will no longer have any credibility, whatever the legal niceties.

The reality is that Icelanders have erupted in collective rage at what they believe to be gross injustice and "gunboat diplomacy" by Downing Street. What rankles is Britain's use of anti-terrorism law to freeze Iceland's assets. The Icelandic central bank was listed besides al-Qaeda as a terrorist body – unprecedented treatment for a NATO ally. Holland was careful not to go so far.

"Importers couldn't get trade finance for food. We feel deeply wronged," said Johannes Skulason from InDefence. Shelves were bare for weeks in Icelandic shops as the banking system disintegrated.

Einars Már Gudmundsson, a novelist, said most citizens were unaware that Iceland's three leading banks –Landsbanki, Glitnir and Kaupthing – were operating as global hedge funds with exposure of 11 times Iceland's GDP.

"I had never heard of Icesave till this happened," said Mr Gudmundsson. "We were told that what these banks did abroad was nothing to do with us but when it all went wrong the responsibility fell back on us. Profits were privatised, but losses were nationalised."

He added: "We're told if we reject the terms, we will be the Cuba of the North. But if we accept, we'll be the Haiti of the North."

Both Britain and Holland expect Iceland to stick to its agreement, but the legal claims are far from watertight. Iceland accepted "political responsibility" for the 320,000 British and Dutch deposits in exchange for lenient terms (arguably denied) in November 2008, but never accepted the legal claim.

The UK has refunded private savers up to £50,000, but councils such as Kent are relying on the deal to recoup their money. They have retrieved £100m of the £900m put in Icelandic accounts.

Iceland's Left-wing coalition – which unseated free marketeers in February's "Saucepan Revolution" – has backed the Icesave terms, deeming it is the only way for Iceland to move beyond the disastrous episode. The petitioners said they accept that Iceland's people should foot part of the bill, but object to the "Versailles" terms: a loan at 5.55pc interest, to be repaid within 15 years. The central banks said this will increase Iceland's public debt by 20pc of GDP.

A report by Sweden's Riksbank said Britain and Europe share blame for the fiasco. It said "absurd" EU rules – which cover Iceland indirectly – told states to set up a "guarantee scheme" for banks, but never said taxpayers were liable for losses.

The reports added that the UK "hardly bothered" to inform savers that the schemes were ill-funded. "The conclusion is clear: the EU host countries (UK and Holland) are also to blame for Iceland's disaster. It would be reasonable that they carry some of the burden. It takes two to tango," it said.

The UK Financial Services Authority said it was unable to stop Icelandic banks raising deposits in the UK under the EU's "passport" system, even when they began milking UK customers to cover losses at home.

Whatever the rights and wrongs, Iceland was by then already being crushed by a financial tsunami. Britain's use of anti-terror laws at that moment will not sit pretty in diplomatic history.

9.1.10

Finsec Union slams Aussie-owned banks

from TVNZ website

Australian-owned banks are being accused of looking after their overseas shareholders at the expense of local jobs and the New Zealand economy.

The bank workers' union FINSEC says huge dividends have been handed out while jobs are being cut or contracted out to offshore operators.

Spokesman Andrew Campbell says he is also unhappy at wage freezes and branch closures. He believes ANZ National is the biggest offender.

Campbell says it's time the government got tough over what he calls an immoral disregard to the local economy. He says all through the recession the banks have been turning healthy profits.

Australian-owned banks are being accused of looking after their overseas shareholders at the expense of local jobs and the New Zealand economy.

The bank workers' union FINSEC says huge dividends have been handed out while jobs are being cut or contracted out to offshore operators.

Spokesman Andrew Campbell says he is also unhappy at wage freezes and branch closures. He believes ANZ National is the biggest offender.

Campbell says it's time the government got tough over what he calls an immoral disregard to the local economy. He says all through the recession the banks have been turning healthy profits.

Subscribe to:

Posts (Atom)