19.12.09

Kiwibank needs to be turned into a proper public bank

The article in the Sunday Star Times, Anger at Kiwibank closures (20 Dec 2009), outlines plans by Kiwibank to close 20 branches nationwide. A cost saving initiative by the bank.

While Kiwibank has tried to market its difference to the Australian owned banks who dominate the banking industry in New Zealand, the reality is that Kiwibank currently doesn't offer much of an alternative. That's because Kiwibank was founded by the government in 2002 to operate as a business, one that has to compete "fairly" with other banks, and at the same time deliver a profit to the government.

The comment in the Sunday Star Time article by Jim Anderton, leader of the Progressive Party and proponent of Kiwibank, reveals the limits of the market model of banking that Kiwibank operates under. Anderton justified the closures on the grounds that this is "what happens with a modern business".

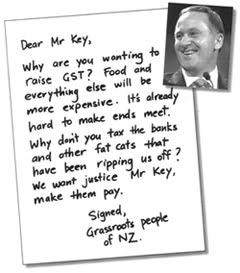

The Bad Banks campaign advocates turning Kiwibank into a proper public bank, as part of major reform of banking in New Zealand. Kiwibank should offer 3% state loans to first home buyers and zero-fee banking to low and middle income people.

This could be financed by raising taxes on the rich, including the introduction of a Financial Transaction Tax (FTT) that nets the banks and other "fat cat" financial speculators that distort the NZ economy.

See Make Kiwibank Public.

Subscribe to:

Post Comments (Atom)

Gutted, our local branch closed this year and had made a direct impact into the way we bank and are

ReplyDeletehaving to reconsider our options now. Silly really... the perfect business bank location (Te Puni) is now just a public carpark.