by Matt McCarten

from NZ Herald

13 December 2009

The Australian banks last week had their Prime Minister scolding them to take a hard look at themselves. That's because they snuck through an interest rate rise after their Reserve Bank raised its rates.

Westpac was the worst with a 45-point hike, even though the Reserve Bank raised the rate by only 25 points.

Westpac rubbed salt into its customers' wounds by sending them an email comparing the bank's profit-gouging decision to a situation when a tropical storm hits a banana plantation. Apparently, such an occurrence would increase the price of a banana smoothie.

Of course, the comparison was dishonest and patronising.

A bank's unethical profiteering that puts people in a situation of not being able to pay their mortgage is outrageous enough. But comparing it with paying more for a banana smoothie has caused a furore in Australia.

Westpac won't want that public relations disaster following it over here, given it has announced it is making over its New Zealand brand to show how much it cares about us.

The other Australian banks (ANZ, ASB, BNZ and National) have followed with a charm offensive, too. There are lots of soothing words about how they want to get closer to New Zealanders by opening more branch offices and offering more intimate services.

It's a bit hard to understand their strategy, given they recently sacked hundreds of Kiwi bank tellers and shipped their work offshore to call-centre factories. It seems only yesterday we were being told local bank branch closures would save us money.

Despite those rather inconvenient truths, the public relations campaign to win our goodwill is well under way. Recently, BNZ proudly promoted its public spirit credentials by closing its doors for a day and paying its employees to do community work for the day.

I'm not trying to piss on the parade, but the day after, I was in a BNZ bank and the staff were running ragged. One of them dryly noted that BNZ got good publicity, but it also meant the workers had to fit five days' work into four days that week.

One of the BNZ's main competitors, the ASB Bank, is now rebranded as the "caring bank". It also claims to have been a "Kiwi bank since 1847".

I doubt the Commonwealth Bank of Australia is aware of the new change of ownership.

It seems that the new initiatives to win our favour are twofold. Despite the widespread political opposition and scepticism to setting up a publicly owned community, Kiwibank has gone from strength to strength as many New Zealanders have swapped their bank accounts over. Nationalism and sovereignty are strong emotions.

The second reason is the public mood is going dog on them. There's been too much news about interest fixing, exorbitant fees and the outrageous tax evasion cases now before the courts.

That's on top of the increasing numbers of ordinary New Zealanders losing their homes as the banks start foreclosing on them.

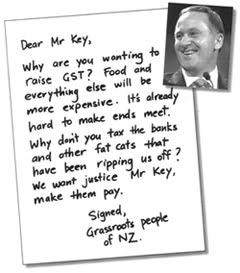

Vaughan Gunson from the Bad Bank campaign claims the Australian bank owners are terrified that the public sentiments will lead to politicians on both sides of the Tasman following their American colleagues and regulating the industry to curb its excessive profiteering. Gunson blames the banks for causing the financial crisis that almost collapsed the global economy.

The Bad Bank supporters picketed a bank in downtown Auckland on Friday as part of their campaign to force the Government to hold a formal inquiry into the role of banks in this country.

Westpac ran a stupid banana campaign, says Gunson, but the whole world banking system has gone bananas. One slip on a skin and we're all gone.

The Government's siding with the Australian bank owners in not holding an inquiry makes me nervous.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment