Bad Banks media release

20 December 2009

An article in the Sunday Star Times, Anger at Kiwibank closures (20 Dec 2009), outlines plans by Kiwibank to close 20 branches nationwide. A cost saving initiative by the bank.

"This decision by Kiwibank bosses shows that when it comes to maintaining its "bottom line" there's not much difference between Kiwibank and the other banks, " says Vaughan Gunson, Bad Banks campaign manager.

"Kiwibank has tried to market its difference to the Aussie banks (ANZ National, BNZ, Westpac and ASB) who dominate the banking industry in New Zealand, but the reality is simply that Kiwibank currently doesn't offer much of an alternative," says Gunson. "That's because Kiwibank was founded by the government in 2002 to operate as a business, one that has to compete "fairly" with other banks, and at the same time deliver a return to the government."

The comment in the Sunday Star Times article by Jim Anderton, leader of the Progressive Party and proponent of Kiwibank, reveals the limits of the market model that Kiwibank operates under. Anderton justified the closures on the grounds that this is "what happens with a modern business".

"Anderton is right," says Gunson, "a modern business serves its own purpose, not the wider needs of the community. This is the whole problem with the banking sector in this country and internationally".

"The financial implosion that almost brought down the global economy last year, and which is continuing to wreck havoc on the lives of grassroots people, shows that we need to urgently rein in the power of the banks, " says Gunson. "Turning Kiwibank into a proper public bank would be a good start."

"A proper public bank", says Gunson, "could offer 3% state loans to first home buyers and zero-fee banking to low and middle income people. Such bold and sensible initiatives would transform banking in this country."

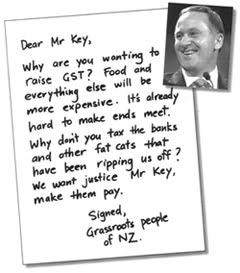

"Public service banking could easily be financed by raising the taxes on the wealthy, including the introduction of a Financial Transaction Tax (FTT) that nets the banks and other "fat cat" financial speculators that distort the NZ economy," says Gunson.

To contribute to the national debate that we must have in New Zealand about the banking system, Bad Banks offers these suggestions for transforming the power relationship between banks and the people:

1. Immediate government intervention to stop banks turfing "mum and dad" homeowners out of their homes because of a job loss or income cut.

2. The establishment of a government regulatory body to oversee the renegotiation of mortgages based on realistic market values and the ability of the homeowner to pay.

3. Turn Kiwibank into a proper "public service" bank offering first-home buyers a 3% interest state loan.

4. Zero-fee banking offered to people on modest incomes. Facilitated by expanding the role of Kiwibank and forced regulation of all banks operating in New Zealand.

5. Introduction of a Financial Transaction Tax (FTT) that would net the banks and other financial speculators. A decisive step in shifting the tax burden off low and middle income people and onto the mega-rich.

6. All bank loans to big business over a fixed amount to be approved by a government regulatory body that acts to protect the environment and communities. Such a measure is essential to preventing powerful global banking interests from sabotaging the necessary emergency mobilisation against climate change.

7. A full public inquiry which looks at every aspect of banking operations in New Zealand, with public meetings held throughout the country, so that grassroots people can tell their stories.

For more comment, contact:

Vaughan Gunson

Bad Banks campaign manager

(09)433 8897

021-0415 082

svpl@xtra.co.nz

-----------------------------------------------------

Backgrounder:

Anger at Kiwibank closures

from Sunday Star Times

20 December 2009

Kiwibank - the brand that brought local banking back into fashion - is axing more than 20 of its branches, angering customers who bought into its patriotism-based advertising.

The closures come as Kiwibank instigator, Jim Anderton, credits the bank with reversing a trend towards shutting small branches.

David Tripe, director of Massey University's Centre for Banking Studies, said Kiwibank was undermining its own public relations pitch. "Essentially they're looking to close branches for the same reason as all the other banks closed them in the 1990s."

Since launching in 2002, Kiwibank has attracted 650,000 customers. Its advertising uses World War II-era imagery to push a theme of resistance to foreign invaders - the overseas-owned banks, which shut more than 1300 New Zealand branches in the 1980s and 1990s.

Since January, Kiwibank's owner, New Zealand Post, has either shut, or announced plans to shut, at least 20 of its about 300 branches, prompting public meetings, petitions and demonstrations.

Kiwibank exists in two forms: either as a franchise, typically run by a small business owner out of a dairy or stationery shop, or as part of a corporate branch of NZ Post. In some cases, NZ Post has shut a Kiwibank franchise and directed customers to one of its corporate branches. In others, where a franchisee has opted out, customers have received letters from New Zealand Post blaming the closure on the franchisee, but has not said if it has sought a replacement.

Kiwibank spokesman Bruce Thompson said two branches had opened in the past year. Another 29 had been upgraded or relocated, or both.

Anderton said Kiwibank's network was still the biggest of any bank operating in New Zealand. That included more than 30 towns and suburbs where there were no other banks.

Since Kiwibank opened, not a single overseas-owned bank had shut a branch in New Zealand. The closures were "what happens with a modern business".

Tripe said Kiwibank faced the same challenge as any other bank in making branches work - generating enough revenue to surpass running costs. In the case of the 20 closures, Kiwibank had responded no differently to the major banks.

KIWIBANKS AXED

(Including closures of actual buildings, as well as downgrades of PostShops offering Kiwibank and bill payment services.)

Mahora, Hastings

Glendene, Auckland

Te Puni, Lower Hutt

Henderson, Auckland

Braid Rd, St Andrews, Hamilton

H&J Smith, Invercargill

Balmoral, Auckland

Sandringham, Auckland

Papatoetoe South, Auckland

Greenwoods Corner, Auckland

Redwood Downs, Christchurch

Onekawa, Napier

Beckenham, Christchurch

Hereford St, Christchurch

Waimairi Rd, Ilam, Christchurch

Hokowhitu, Palmerston North

Awapuni, Palmerston

North Books and More, High St, Lower Hutt

Linwood, Christchurch

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment