by Adrian Hatwell

from BusinessDay.co.nz

Australian-owned ANZ Bank has won the annual Roger Award for worst transnational company operating in New Zealand, due to its leading role in the nation’s financial sector strife.

A panel of five judges said foreign-owned banks in general were a large drain on New Zealand’s economy.

Allegations of distortions of lending margins, tax avoidance, risky lending practices, overcharging, and poor customer treatment were rife, the judges said.

However the ANZ’s behaviour during 2009, particularly its part in the ING funds fiasco, made the bank the unanimous pick for the top title, they said.

ANZ did not respond to requests for comment on its Roger Award win.

Murray Horton, secretary for Campaign Against Foreign Control of Aotearoa, the award’s organiser, describes the annual event as a sort of “people’s court” in which the public nominate candidates and a panel of experts weigh the facts and evidence before making a judgment.

Dr Joce Jesson, senior lecturer in critical studies at Auckland University and one of this year’s judges, believed the award blows apart the bank’s careful PR campaign and shows the public the company’s true face.

“The banks want you to believe that they are there for you, but no, the bank is there for [its foreign owners],” said Dr Jesson.

“We need to start recognising that these banks rip money out of New Zealand.”

Fellow judge, Dr Wayne Hope, associate professor of communications studies at AUT University, agreed that although ANZ had distinguished itself above its competition, the award indicated problems with the transnational-focus of the banking system in general.

“The judges’ report is important,” said Dr Hope, “because it contributes to the ongoing public debate about what it is that banks do, and the need for people to get a fair deal.”

One of the leading factors in ANZ’s win was its handling of last year’s ING affair, which saw 13,000 small investors misled into taking money out of safe term deposits and moving it into high-risk funds, which were then frozen as their value plummeted.

The Frozen Funds Group represents 1,100 of those affected in the ING fiasco, many of who are elderly and lost their entire savings in the funds.

FFG spokesperson Gerard Prinsen was delighted with ANZ’s Roger Award win.

"It’s fantastic,” Prinsen said. “They battled hard and did their utmost best, they deserved to win. Totally.”

He was particularly impressed with the way the bank had upset almost every party in parliament.

“[It put] Act, Labour, and the Greens all in the same boat to row against the ANZ.”

The Commerce Commission will conclude a 17-month investigation of ANZ’s handling of the ING matter at the end of the month. If the bank is found to have breached the law then compensation could be paid to investors.

Prinsen said that although the system may be slow and complex, the progress of the Frozen Funds Group shows that it does work.

The Roger Award judges were less confident in the current system’s ability to keep banks honest and urged further government regulation.

There was general agreement that one thing people can do to avoid the issues raised by this year’s award is to move their business from Australian-owned banks to local alternatives.

“Many of the people [burned in the ING affair] have been lifetime customers of the ANZ, for 50 to 60 years,” said Prinsen. “To see the bank treat you like this, it really hurts.”

Rio Tinto Aluminium was the runner-up for the 2009 award, with Telecom in third place. The Auckland City Council was awarded the Accomplice Award for its part in privatising the city’s waste management system through Transpacific Industries Group.

16.3.10

Bad Banks leaflet #6: MAKE THE BANKS PAY

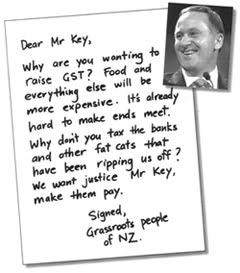

The latest Bad Banks leaflet is out now (leaflet #6). It features on the front a "letter" to prime minister John Key, which reads:

SIGN ON TO OUR "LETTER" TO JOHN KEY

To go with the new leaflet, there's a 'Make the Banks Pay' sign-up sheet where people can give their support to our "letter" to John Key and the three demands.

If you would like bulk copies of Bad Banks leaflet #6 and the 'Make the Banks Pay' sign-up sheet, contact Vaughan svpl(at)xtra.co.nz or 021-0415 082.

Send all completed sign-up sheets to Socialist Worker/Bad Banks, PO Box 13-685, Auckland.

SIGN ON ONLINE

There's an online version of the 'Make the Banks Pay' sign-up. Go to http://www.ipetitions.com/petition/badbanks/ to add your signature. Tell your friends, family and workmates. We want to get as many signatures as possible, to grow the campaign and hopefully get crucial media coverage.

You can also join, and invite others to join, the 'Make the Banks Pay' Facebook group. Go to http://www.facebook.com/#!/group.php?gid=392390694275&ref=ts

IN THE MEDIA AT BUDGET TIME

There's going to be a lot of media coverage either side of the upcoming budget (20 May) about an almost certain hike in GST, as well as other policies the National government will be implementing in response to the global economic crisis. It's possible that the alternative message of the Bad Banks campaign: "make the banks pay, not grassroots people", could break through into the media. That possibility will be increased if we can build some campaign momentum on the ground and online over the next couple of months.

If we work hard we may be able to lift the Bad Banks campaign to the next level. The three "common sense" measures are necessary to curb banking power and protect grassroots people in New Zealand. If we act together we just might be able to deliver a blow to the banks.

In solidarity,

Vaughan Gunson

Bad Banks campaign manager

svpl(at)xtra.co.nz

021-0415 082

Dear Mr Key,On the back of the leaflet, under the headline 'Make the Banks Pay' are three demands:

Why are you wanting to raise GST? Food and everything else will be more expensive. It's already hard to make ends meet. Why don't you tax the banks and other fat cats that have been ripping us off? We want justice Mr Key, make them pay.

Signed,

Grassroots people of NZ

1. Stop forced mortgagee salesThese "common sense" measures to curb banking power and protect grassroots people should hit the mark with people who already have negative attitudes towards the banks, which is the majority of New Zealanders. Early feedback from people on the street to the new leaflet has been positive.

Regulatory muscle used to stop banks turfing people out of their homes. A government body to oversee the re-negotiation of mortgages based on current market values and ability of the homeowner to pay.

2. Turn Kiwibank into a proper public bank

Offering 3% interest loans to first home buyers, zero-fee banking for people on modest incomes, and low interest loans to local bodies for sustainable eco-projects in the public good.

3. Introduce a Robin Hood Tax

(also known as a Financial Transaction Tax)

A small percentage tax on financial transactions would net billions of dollars from banks and global financial speculators. GST could be phased out.

SIGN ON TO OUR "LETTER" TO JOHN KEY

To go with the new leaflet, there's a 'Make the Banks Pay' sign-up sheet where people can give their support to our "letter" to John Key and the three demands.

If you would like bulk copies of Bad Banks leaflet #6 and the 'Make the Banks Pay' sign-up sheet, contact Vaughan svpl(at)xtra.co.nz or 021-0415 082.

Send all completed sign-up sheets to Socialist Worker/Bad Banks, PO Box 13-685, Auckland.

SIGN ON ONLINE

There's an online version of the 'Make the Banks Pay' sign-up. Go to http://www.ipetitions.com/petition/badbanks/ to add your signature. Tell your friends, family and workmates. We want to get as many signatures as possible, to grow the campaign and hopefully get crucial media coverage.

You can also join, and invite others to join, the 'Make the Banks Pay' Facebook group. Go to http://www.facebook.com/#!/group.php?gid=392390694275&ref=ts

IN THE MEDIA AT BUDGET TIME

There's going to be a lot of media coverage either side of the upcoming budget (20 May) about an almost certain hike in GST, as well as other policies the National government will be implementing in response to the global economic crisis. It's possible that the alternative message of the Bad Banks campaign: "make the banks pay, not grassroots people", could break through into the media. That possibility will be increased if we can build some campaign momentum on the ground and online over the next couple of months.

If we work hard we may be able to lift the Bad Banks campaign to the next level. The three "common sense" measures are necessary to curb banking power and protect grassroots people in New Zealand. If we act together we just might be able to deliver a blow to the banks.

In solidarity,

Vaughan Gunson

Bad Banks campaign manager

svpl(at)xtra.co.nz

021-0415 082

13.3.10

Bad Bank wins Roger Award

ANZ has won the Roger Award for the worst transnational corporation operating in New Zealand in 2009. Below is the judge's statement relating to the winner, ANZ. The judges were Christine Dann, Bryan Gould, Joce Jesson, Paul Corliss and Wayne Hope.

The Roger Award is organised each year by CAFCA (Campaign against Foreign Control of Aotearoa).

From the judge's statement:

The Winner: ANZ

The judges all noted the generally egregious behaviour of the Australian-owned banks that were nominated (ANZ, BNZ and Westpac), and were unanimous in picking them as the worst TNCs operating in New Zealand in 2009.

As the Council of Trade Unions noted in its submission to the Independent Parliamentary Banking Inquiry, the foreign–owned banks are the Achilles heel of the New Zealand economy, given that they contribute to the lion’s share of the national debt. They account for nearly 70% of investment income debts on the national balance of payments and for 74% of the economy’s net overseas indebtedness.

During the 2009 year the banks were accused of:

1. Distorted lending margins in their favour and against their customers

2. Tax dodging on a grand scale

3. Poor lending and investment practices

4. Overcharging and profiteering

5. Poor employment and customer service practices

The banks behaved so badly in 2009 (and 2008) that they were the subject of a Parliamentary Select Committee investigation early in 2009. Despite receiving reports giving good reason to conclude that strong Government action was needed to rein in the bad behaviour of the banks, and to require them to deal with both customers (and the Government, which provided them with security during the 2008 financial crisis) more honestly and fairly, the National Party-dominated Select Committee did not recommend such actions to Government. This led to the Labour, Green and Progressive MPs setting up their own Independent Parliamentary Banking Inquiry. This Inquiry exposed more issues of concern, and called for better legislation and regulation to protect the public from predatory banks.

Also during 2009, bank after bank appeared before the High Court to answer allegations of tax evasion, amounting to billions of dollars. After high level negotiations they finally reached an out-of-court settlement that saw them collectively pay the Inland Revenue Department more than $2.2 billion. In a political climate where we are constantly being told that taxes are an evil imposition, rather than what they really are - the price we pay for a democratic and functional society - we think that a special Public Heroes award should go to the Government lawyers, IRD officials and others responsible for getting these slippery banking snakes to pay what they rightly owe the nation.

One of the Roger Award judges noted the banks were richly deserving of the Award since they have been ''...doing great damage for many years to the whole of the New Zealand economy …through irresponsible lending (thereby stoking inflation), and expatriating excessive profits … while all the time avoiding censure and pointing the finger at public spending as the cause of our economic problems…[While] this year we have seen the truly scandalous tax avoidance saga, from which the banks have again escaped remarkably lightly; if you or I had committed a similar offence of one thousandth the size we would have ended up in jail.”

However, it was a tough decision to pick the worst of the worst, considering that all the foreign-owned banks were guilty of some degree of tax dodging, overcharging on credit card fees and loans, not passing on reductions in interest rates, and treating customers and staff poorly. In the end the judges decided that ANZ deserved top place, with the ING scandal tipping the balance in its favour (for full details of the ING scandal, see the next section “Rattlesnakes In the Grass’).

In 2008 ANZ was also a finalist, with the 2008 judges noting the following ‘fine’ qualities for its inclusion:

“Evidence presented to the judges portrayed ANZ-National as the most rapacious, inept and irresponsible of the banks over the past couple of years, which assured it a good chance of securing the Roger Award. This bank was a distinguished finalist in 2007 also, for its despicable role in the saga of Godfrey Hirst and the Feltex carpet business”.ANZ has succeeded in winning the 2009 Roger Award because the ING funds fiasco is simply and plainly ‘pure greed capitalism’ at its worst. This debacle saw the bank immorally misleading small investors into taking their money out of safe term deposits and putting it into highly risky investments, while assuring them that these investments were safe. In fact, most of them were highly dangerous and dodgy, and lost millions of investors' money. When the betrayed investors got organised and put pressure on the bank to repay what had been lost, ANZ's repayment offer came with big strings attached - investors who refused to sign a waiver agreeing not to take legal action against the bank would receive no compensation. In the words of the judges, this was ‘the most extreme case of anti-democratic manipulation by a transnational within New Zealand during 2009. Simply, ANZ was employing financial pressure to erase the legal rights of investors – a truly Roger winning performance.’

The ING debacle was, as one judge noted, ‘the icing on the already baked Roger cake.’ Thus ANZ is the winner of the 2009 Roger Award.

2.3.10

We could replace tax on essentials with one on destructive speculation

by Barry Coates

from stuff.co.nz

2 March 2010

Some things seem too good to be true. But sometimes it's because they are good ideas whose time has come. One of those is the proposal to levy a tiny tax on the massive movements of money around the world. It's time our Government looked more closely at it.

Why? Because a financial transactions tax will raise significant revenue without adversely affecting most New Zealanders, support our international obligations and reduce the volatility of our currency. It's a win-win-win.

Instead, our Government's attention has been focused on incremental tax reforms that shuffle taxes from one pocket to the other - lower direct taxes and higher GST. The net effect inevitably seems to be that those on lower incomes bear a greater share of the burden. This is all "business as usual" ignoring some longer-term challenges that we face - reform of the financial sector to curb excessive risk-taking, making the transition to a low-carbon economy, and playing our part in the global effort to eradicate extreme poverty.

The proposed FTT is a levy of 0.05 per cent, on average, applied to the trading of a range of equities, bonds, derivatives and foreign exchange transactions (ie 5 cents for a transaction of $100). Such a tax is predicted to curb a lot of speculative activity, but would still raise NZ$570 billion a year globally.

It sounds like a radical proposal, but it is really like extending GST, at a much reduced rate, to wholesale financial transactions - they are currently exempt. It is supported by Japan and leaders of the three largest EU countries - Gordon Brown, Angela Merkel and Nicolas Sarkozy - along with hundreds of eminent economists, financial regulators like Lord Turner and Paul Volcker, financial traders like George Soros and investment guru Warren Buffet.

An international agreement for all countries to introduce a common FTT at the same time would be ideal. This approach is now being considered by the IMF and G20 countries. It should be supported by our Government. But difficulties in getting such a deal should not prevent countries from moving ahead themselves.

Belgium already runs a limited form of FTT and its banking sector has not suffered. A co-ordinated approach would be preferable, but any government can now introduce a levy on trading of their currency, no matter where the transactions take place. The high level of automation in the banking industry makes administration feasible at a low cost.

Ad Feedback

This tax would miss the average bank customer completely, even those buying foreign currency to travel overseas. It is a tax on wholesale finance - it would apply to the high-volume, high-frequency trading and speculation that sees massive sums of money being transferred at a keystroke. The "casino economy" of global finance has grown rapidly in recent years - international financial transactions are now 60 times the level of world GDP. Unfortunately the real economy is not insulated from its collapses. The financial crisis cost the world a staggering US$11.9 trillion, according to the IMF.

The finance industry is a deliberate target for the FTT. It is the most profitable industry in the world, with profits per employee 26 times as high as other business sectors. And, as we have seen in New Zealand, banks are adept at using legal loopholes and tax havens to avoid paying their fair share of tax. The FTT could generate enough revenue to avoid raising GST, replacing taxes on life's essentials with a tax on socially destructive financial speculation. This is consistent with the principle of taxing activities that we want to discourage, as opposed to taxing productive work or basic necessities.

Nobel-prize-winning economist James Tobin described such a tax as "throwing sand in the wheels" of international currency trading. Some sand may well help reduce the volatility of the New Zealand dollar, which attracts massive trading and speculative attacks - according to the Bank of International Settlements, the Kiwi dollar is the 11th most traded currency, far beyond our role in the real economy.

The proposal put forward by a large coalition of groups internationally, under the banner of the "Robin Hood" tax, is that half of the funds raised would be used domestically to help fund public services and reduce government deficits resulting from the financial crisis. A quarter of the funds would be contributed to support international efforts to overcome extreme poverty in the developing world and support the countries that have suffered most from the financial crisis.

The balance would be used to tackle climate change. It could dramatically reduce the emissions from global deforestation and provide most of the funding that is needed by vulnerable countries, including our Pacific neighbours, to protect themselves and adapt to climate change impacts.

Before we dismiss the idea, consider this: just two minutes of a global FTT could pay for basic healthcare for 100,000 people. Two months of the FTT would provide the funds necessary to get every child on Earth into school.

Our Government should take a close look.

Barry Coates is the executive director of Oxfam New Zealand.

from stuff.co.nz

2 March 2010

Some things seem too good to be true. But sometimes it's because they are good ideas whose time has come. One of those is the proposal to levy a tiny tax on the massive movements of money around the world. It's time our Government looked more closely at it.

Why? Because a financial transactions tax will raise significant revenue without adversely affecting most New Zealanders, support our international obligations and reduce the volatility of our currency. It's a win-win-win.

Instead, our Government's attention has been focused on incremental tax reforms that shuffle taxes from one pocket to the other - lower direct taxes and higher GST. The net effect inevitably seems to be that those on lower incomes bear a greater share of the burden. This is all "business as usual" ignoring some longer-term challenges that we face - reform of the financial sector to curb excessive risk-taking, making the transition to a low-carbon economy, and playing our part in the global effort to eradicate extreme poverty.

The proposed FTT is a levy of 0.05 per cent, on average, applied to the trading of a range of equities, bonds, derivatives and foreign exchange transactions (ie 5 cents for a transaction of $100). Such a tax is predicted to curb a lot of speculative activity, but would still raise NZ$570 billion a year globally.

It sounds like a radical proposal, but it is really like extending GST, at a much reduced rate, to wholesale financial transactions - they are currently exempt. It is supported by Japan and leaders of the three largest EU countries - Gordon Brown, Angela Merkel and Nicolas Sarkozy - along with hundreds of eminent economists, financial regulators like Lord Turner and Paul Volcker, financial traders like George Soros and investment guru Warren Buffet.

An international agreement for all countries to introduce a common FTT at the same time would be ideal. This approach is now being considered by the IMF and G20 countries. It should be supported by our Government. But difficulties in getting such a deal should not prevent countries from moving ahead themselves.

Belgium already runs a limited form of FTT and its banking sector has not suffered. A co-ordinated approach would be preferable, but any government can now introduce a levy on trading of their currency, no matter where the transactions take place. The high level of automation in the banking industry makes administration feasible at a low cost.

Ad Feedback

This tax would miss the average bank customer completely, even those buying foreign currency to travel overseas. It is a tax on wholesale finance - it would apply to the high-volume, high-frequency trading and speculation that sees massive sums of money being transferred at a keystroke. The "casino economy" of global finance has grown rapidly in recent years - international financial transactions are now 60 times the level of world GDP. Unfortunately the real economy is not insulated from its collapses. The financial crisis cost the world a staggering US$11.9 trillion, according to the IMF.

The finance industry is a deliberate target for the FTT. It is the most profitable industry in the world, with profits per employee 26 times as high as other business sectors. And, as we have seen in New Zealand, banks are adept at using legal loopholes and tax havens to avoid paying their fair share of tax. The FTT could generate enough revenue to avoid raising GST, replacing taxes on life's essentials with a tax on socially destructive financial speculation. This is consistent with the principle of taxing activities that we want to discourage, as opposed to taxing productive work or basic necessities.

Nobel-prize-winning economist James Tobin described such a tax as "throwing sand in the wheels" of international currency trading. Some sand may well help reduce the volatility of the New Zealand dollar, which attracts massive trading and speculative attacks - according to the Bank of International Settlements, the Kiwi dollar is the 11th most traded currency, far beyond our role in the real economy.

The proposal put forward by a large coalition of groups internationally, under the banner of the "Robin Hood" tax, is that half of the funds raised would be used domestically to help fund public services and reduce government deficits resulting from the financial crisis. A quarter of the funds would be contributed to support international efforts to overcome extreme poverty in the developing world and support the countries that have suffered most from the financial crisis.

The balance would be used to tackle climate change. It could dramatically reduce the emissions from global deforestation and provide most of the funding that is needed by vulnerable countries, including our Pacific neighbours, to protect themselves and adapt to climate change impacts.

Before we dismiss the idea, consider this: just two minutes of a global FTT could pay for basic healthcare for 100,000 people. Two months of the FTT would provide the funds necessary to get every child on Earth into school.

Our Government should take a close look.

Barry Coates is the executive director of Oxfam New Zealand.

Subscribe to:

Posts (Atom)