£40bn more to be added to banking bail-out ‘fiddle’

from Socialist Resistance

3 November 2009

Today, it has been announced that another £40 billion is to go into the Lloyds/HBOS & RBS Bank bail-outs. Alastair Darling says it represents a “better deal for the taxpayer”. But “better deal for the taxpayer” than what?

The reality in fact is that best deal for the tax payer would be the complete nationalisation of all these banks without compensation, this since without the state’s intervention they’d all already be bankrupt and likely have dragged down the entire UK banking system with them. This would have made most shares and not only those of the Banks completely worthless.

Given the Government stepped in precisely to avoid the latter, and indeed to avoid the possible collapse of the entire Capitalist system as a whole, surely the very least a due diligent, astute and businessman-like ‘taxpayer’ should have expected is for ‘the state’ to have picked up these bankrupt businesses lock stock and barrel for absolutely nothing - especially given the unknown liabilities being taken on. That’s usually what happens in the real ‘free market’ world, and in some cases with criminal/civil proceedings being taken out against those responsible for the bankruptcy.

However, instead of taking over these banks entirely as it did with Northern Rock, the Government decided instead to allow these banks’ shareholders to keep their shares, giving them a financial value they wouldn’t otherwise possess. In so doing the Government effectively unnecessarily transferred many £billions of ‘taxpayers’ money directly to the value of the share portfolios of those banks’ current and former investors.

Furthermore, if the Government’s plans work out and the share-value of these banks rise and the banks themselves can be re-floated (i.e. re-privatised) the biggest beneficiary won’t be so much the taxpayer who has effectively taken on all of these banks’ entire liabilities and the ‘risks’ associated with them (and will likely continue to do so), but their existing private shareholders i.e the very same people who had they invested in other sectors of the economy would have lost their shirts and have nothing to show for their investment whatsoever!

The part nationalisation of Lloyds/HBOS/RBS is one humongous fiddle that needs exposing. It’s not the nationalisation part that’s wrong but that the state has decided to reward the shareholders of these otherwise bankrupt banks with anything (i.e. a part share in a nationalised bank) and is currently directing huge resources to their re-privatisation.

Also, if state intervention including nationalisation is right for the banks (and/or under certain circumstances) why not other sectors of the economy in other circumstances? And if such huge sums of money can be found almost at a drop of a hat to ’sort out the banks’ (the £40 billion injection today just further shores up existing investors, will not create any new jobs, but rather is to be accompanied with staff cuts) why not much smaller amounts for environmentally ‘friendly’, job creation and economically more reflationary measures such as a massively expanded public transport system that is fully integrated, publicly owned and free to everyone at the point of use, such as is being advocated by the Campaign for Free Public Transport?

Along with the complete nationalisation of Lloyds/HBOS/RBS without compensation, free and better public transport and many other similar ideas would be much ‘better value’ to the taxpayer, whatever they cost, than the £40bn being used to re-capitalise these otherwise ‘bankrupt’ banks today, and the ultimate purpose of which as already indicated, is to nothing other than to assist in their future re-privatisation.

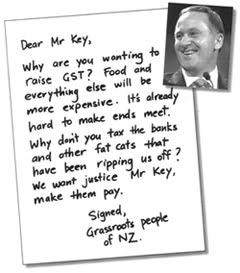

We really should be making the bankers and bank shareholders pay for the financial shit we’re in rather than rewarding them! Plus if we can find the money to bail-out and re-capitalise the banks, which we wouldn’t actually need if we owned them outright, then that should be being used to defend existing jobs and to create new ones and/or avoiding us ordinary folk having to pay for it.

3.11.09

Free public transport instead of bailouts for the banks

Rather than bailing out the banks with trillions of dollars of public money, which governments in Europe and North America have been doing, ecosocialists in Britain are calling for "environmentally friendly job creation" and "a massively expanded public transport system that is fully integrated, publicly owned and free".

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment