by Barry Coates

from stuff.co.nz

2 March 2010

Some things seem too good to be true. But sometimes it's because they are good ideas whose time has come. One of those is the proposal to levy a tiny tax on the massive movements of money around the world. It's time our Government looked more closely at it.

Why? Because a financial transactions tax will raise significant revenue without adversely affecting most New Zealanders, support our international obligations and reduce the volatility of our currency. It's a win-win-win.

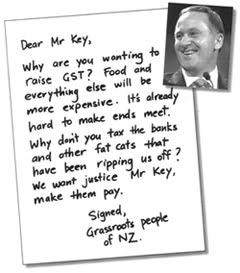

Instead, our Government's attention has been focused on incremental tax reforms that shuffle taxes from one pocket to the other - lower direct taxes and higher GST. The net effect inevitably seems to be that those on lower incomes bear a greater share of the burden. This is all "business as usual" ignoring some longer-term challenges that we face - reform of the financial sector to curb excessive risk-taking, making the transition to a low-carbon economy, and playing our part in the global effort to eradicate extreme poverty.

The proposed FTT is a levy of 0.05 per cent, on average, applied to the trading of a range of equities, bonds, derivatives and foreign exchange transactions (ie 5 cents for a transaction of $100). Such a tax is predicted to curb a lot of speculative activity, but would still raise NZ$570 billion a year globally.

It sounds like a radical proposal, but it is really like extending GST, at a much reduced rate, to wholesale financial transactions - they are currently exempt. It is supported by Japan and leaders of the three largest EU countries - Gordon Brown, Angela Merkel and Nicolas Sarkozy - along with hundreds of eminent economists, financial regulators like Lord Turner and Paul Volcker, financial traders like George Soros and investment guru Warren Buffet.

An international agreement for all countries to introduce a common FTT at the same time would be ideal. This approach is now being considered by the IMF and G20 countries. It should be supported by our Government. But difficulties in getting such a deal should not prevent countries from moving ahead themselves.

Belgium already runs a limited form of FTT and its banking sector has not suffered. A co-ordinated approach would be preferable, but any government can now introduce a levy on trading of their currency, no matter where the transactions take place. The high level of automation in the banking industry makes administration feasible at a low cost.

Ad Feedback

This tax would miss the average bank customer completely, even those buying foreign currency to travel overseas. It is a tax on wholesale finance - it would apply to the high-volume, high-frequency trading and speculation that sees massive sums of money being transferred at a keystroke. The "casino economy" of global finance has grown rapidly in recent years - international financial transactions are now 60 times the level of world GDP. Unfortunately the real economy is not insulated from its collapses. The financial crisis cost the world a staggering US$11.9 trillion, according to the IMF.

The finance industry is a deliberate target for the FTT. It is the most profitable industry in the world, with profits per employee 26 times as high as other business sectors. And, as we have seen in New Zealand, banks are adept at using legal loopholes and tax havens to avoid paying their fair share of tax. The FTT could generate enough revenue to avoid raising GST, replacing taxes on life's essentials with a tax on socially destructive financial speculation. This is consistent with the principle of taxing activities that we want to discourage, as opposed to taxing productive work or basic necessities.

Nobel-prize-winning economist James Tobin described such a tax as "throwing sand in the wheels" of international currency trading. Some sand may well help reduce the volatility of the New Zealand dollar, which attracts massive trading and speculative attacks - according to the Bank of International Settlements, the Kiwi dollar is the 11th most traded currency, far beyond our role in the real economy.

The proposal put forward by a large coalition of groups internationally, under the banner of the "Robin Hood" tax, is that half of the funds raised would be used domestically to help fund public services and reduce government deficits resulting from the financial crisis. A quarter of the funds would be contributed to support international efforts to overcome extreme poverty in the developing world and support the countries that have suffered most from the financial crisis.

The balance would be used to tackle climate change. It could dramatically reduce the emissions from global deforestation and provide most of the funding that is needed by vulnerable countries, including our Pacific neighbours, to protect themselves and adapt to climate change impacts.

Before we dismiss the idea, consider this: just two minutes of a global FTT could pay for basic healthcare for 100,000 people. Two months of the FTT would provide the funds necessary to get every child on Earth into school.

Our Government should take a close look.

Barry Coates is the executive director of Oxfam New Zealand.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment