ANZ has won the Roger Award for the worst transnational corporation operating in New Zealand in 2009. Below is the judge's statement relating to the winner, ANZ. The judges were Christine Dann, Bryan Gould, Joce Jesson, Paul Corliss and Wayne Hope.

The Roger Award is organised each year by CAFCA (Campaign against Foreign Control of Aotearoa).

From the judge's statement:

The Winner: ANZ

The judges all noted the generally egregious behaviour of the Australian-owned banks that were nominated (ANZ, BNZ and Westpac), and were unanimous in picking them as the worst TNCs operating in New Zealand in 2009.

As the Council of Trade Unions noted in its submission to the Independent Parliamentary Banking Inquiry, the foreign–owned banks are the Achilles heel of the New Zealand economy, given that they contribute to the lion’s share of the national debt. They account for nearly 70% of investment income debts on the national balance of payments and for 74% of the economy’s net overseas indebtedness.

During the 2009 year the banks were accused of:

1. Distorted lending margins in their favour and against their customers

2. Tax dodging on a grand scale

3. Poor lending and investment practices

4. Overcharging and profiteering

5. Poor employment and customer service practices

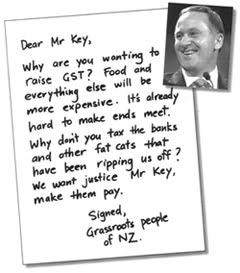

The banks behaved so badly in 2009 (and 2008) that they were the subject of a Parliamentary Select Committee investigation early in 2009. Despite receiving reports giving good reason to conclude that strong Government action was needed to rein in the bad behaviour of the banks, and to require them to deal with both customers (and the Government, which provided them with security during the 2008 financial crisis) more honestly and fairly, the National Party-dominated Select Committee did not recommend such actions to Government. This led to the Labour, Green and Progressive MPs setting up their own Independent Parliamentary Banking Inquiry. This Inquiry exposed more issues of concern, and called for better legislation and regulation to protect the public from predatory banks.

Also during 2009, bank after bank appeared before the High Court to answer allegations of tax evasion, amounting to billions of dollars. After high level negotiations they finally reached an out-of-court settlement that saw them collectively pay the Inland Revenue Department more than $2.2 billion. In a political climate where we are constantly being told that taxes are an evil imposition, rather than what they really are - the price we pay for a democratic and functional society - we think that a special Public Heroes award should go to the Government lawyers, IRD officials and others responsible for getting these slippery banking snakes to pay what they rightly owe the nation.

One of the Roger Award judges noted the banks were richly deserving of the Award since they have been ''...doing great damage for many years to the whole of the New Zealand economy …through irresponsible lending (thereby stoking inflation), and expatriating excessive profits … while all the time avoiding censure and pointing the finger at public spending as the cause of our economic problems…[While] this year we have seen the truly scandalous tax avoidance saga, from which the banks have again escaped remarkably lightly; if you or I had committed a similar offence of one thousandth the size we would have ended up in jail.”

However, it was a tough decision to pick the worst of the worst, considering that all the foreign-owned banks were guilty of some degree of tax dodging, overcharging on credit card fees and loans, not passing on reductions in interest rates, and treating customers and staff poorly. In the end the judges decided that ANZ deserved top place, with the ING scandal tipping the balance in its favour (for full details of the ING scandal, see the next section “Rattlesnakes In the Grass’).

In 2008 ANZ was also a finalist, with the 2008 judges noting the following ‘fine’ qualities for its inclusion:

“Evidence presented to the judges portrayed ANZ-National as the most rapacious, inept and irresponsible of the banks over the past couple of years, which assured it a good chance of securing the Roger Award. This bank was a distinguished finalist in 2007 also, for its despicable role in the saga of Godfrey Hirst and the Feltex carpet business”.ANZ has succeeded in winning the 2009 Roger Award because the ING funds fiasco is simply and plainly ‘pure greed capitalism’ at its worst. This debacle saw the bank immorally misleading small investors into taking their money out of safe term deposits and putting it into highly risky investments, while assuring them that these investments were safe. In fact, most of them were highly dangerous and dodgy, and lost millions of investors' money. When the betrayed investors got organised and put pressure on the bank to repay what had been lost, ANZ's repayment offer came with big strings attached - investors who refused to sign a waiver agreeing not to take legal action against the bank would receive no compensation. In the words of the judges, this was ‘the most extreme case of anti-democratic manipulation by a transnational within New Zealand during 2009. Simply, ANZ was employing financial pressure to erase the legal rights of investors – a truly Roger winning performance.’

The ING debacle was, as one judge noted, ‘the icing on the already baked Roger cake.’ Thus ANZ is the winner of the 2009 Roger Award.

No comments:

New comments are not allowed.