by Adrian Hatwell

from BusinessDay.co.nz

Australian-owned ANZ Bank has won the annual Roger Award for worst transnational company operating in New Zealand, due to its leading role in the nation’s financial sector strife.

A panel of five judges said foreign-owned banks in general were a large drain on New Zealand’s economy.

Allegations of distortions of lending margins, tax avoidance, risky lending practices, overcharging, and poor customer treatment were rife, the judges said.

However the ANZ’s behaviour during 2009, particularly its part in the ING funds fiasco, made the bank the unanimous pick for the top title, they said.

ANZ did not respond to requests for comment on its Roger Award win.

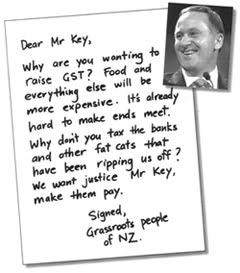

Murray Horton, secretary for Campaign Against Foreign Control of Aotearoa, the award’s organiser, describes the annual event as a sort of “people’s court” in which the public nominate candidates and a panel of experts weigh the facts and evidence before making a judgment.

Dr Joce Jesson, senior lecturer in critical studies at Auckland University and one of this year’s judges, believed the award blows apart the bank’s careful PR campaign and shows the public the company’s true face.

“The banks want you to believe that they are there for you, but no, the bank is there for [its foreign owners],” said Dr Jesson.

“We need to start recognising that these banks rip money out of New Zealand.”

Fellow judge, Dr Wayne Hope, associate professor of communications studies at AUT University, agreed that although ANZ had distinguished itself above its competition, the award indicated problems with the transnational-focus of the banking system in general.

“The judges’ report is important,” said Dr Hope, “because it contributes to the ongoing public debate about what it is that banks do, and the need for people to get a fair deal.”

One of the leading factors in ANZ’s win was its handling of last year’s ING affair, which saw 13,000 small investors misled into taking money out of safe term deposits and moving it into high-risk funds, which were then frozen as their value plummeted.

The Frozen Funds Group represents 1,100 of those affected in the ING fiasco, many of who are elderly and lost their entire savings in the funds.

FFG spokesperson Gerard Prinsen was delighted with ANZ’s Roger Award win.

"It’s fantastic,” Prinsen said. “They battled hard and did their utmost best, they deserved to win. Totally.”

He was particularly impressed with the way the bank had upset almost every party in parliament.

“[It put] Act, Labour, and the Greens all in the same boat to row against the ANZ.”

The Commerce Commission will conclude a 17-month investigation of ANZ’s handling of the ING matter at the end of the month. If the bank is found to have breached the law then compensation could be paid to investors.

Prinsen said that although the system may be slow and complex, the progress of the Frozen Funds Group shows that it does work.

The Roger Award judges were less confident in the current system’s ability to keep banks honest and urged further government regulation.

There was general agreement that one thing people can do to avoid the issues raised by this year’s award is to move their business from Australian-owned banks to local alternatives.

“Many of the people [burned in the ING affair] have been lifetime customers of the ANZ, for 50 to 60 years,” said Prinsen. “To see the bank treat you like this, it really hurts.”

Rio Tinto Aluminium was the runner-up for the 2009 award, with Telecom in third place. The Auckland City Council was awarded the Accomplice Award for its part in privatising the city’s waste management system through Transpacific Industries Group.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment