by Daphne Lawless

UNITY Journal Editor

Simply put, “fractional reserve lending” is the reason why confidence is so important to banks.

Banks don't have to have assets on hand to cover all the loans they issue. In New Zealand, they only need to hang on to 4% of the loans they make for housing – and 8% of other types of loan.

Banks can't just make money up. If they want to lend out $100,000, say, they do need to have that money on their books to start with – from deposits, or from a central government monetary issue.

But the “fractional reserve” rule mean that they don't have to hang on to those reserves when they make loans. If a bank lends $100,000 to a business, they only need to hang on to $8,000 in their own vaults. And only $4,000 if it's for a mortgage.

One benefit of this is that money goes further, and faster. Because that $100,000 that has been lent out will end up as deposits in that same bank, or in other banks.

And then it can be loaned out again – except for the $4,000 or $8,000 reserve. So that's another $92,000 or even $96,000 back into circulation!

This is where we get what is called the “multiplier” effect. Because any initial deposit, or central bank issue, can be loaned out again and again and again, its actual effect on the economy will be much, much bigger than the initial input.

So $100,000 which is made available to business, because it gets loaned out again and again, actually means something like $1,250,000 gets added to the economy. And with housing loans, that becomes a massive $2,500,000!

The flaw in all of this, however, is that it means the system is all down to confidence.

Capitalism needs a constantly growing and expanding economy. Anyone making a loan needs to be pretty sure that they will make enough money to pay it back, and the interest, in the future.

So all this massive creation of credit - $1 million or more, or even $2 million or more – relies on the lenders' confidence in their ability to get it all back, once it's invested. It also relies on the confidence of the depositors – the people who paid in the $100,000 in the first place – that they too will get their money back, with interest.

But what happens when that confidence disappears? It's called a run on the banks.

If depositors have reason to believe that their deposits aren't safe, they run directly to the banks to ask for their deposits back. And of course the banks don't have those deposits – apart from the 4% or 8% that the law required them to keep back.

In some cases, the money in those deposits will have been loaned out, then redeposited by someone else, then loaned out again, then redeposited, over and over and over. That's fine when economic growth means everyone wins. But that can't be guaranteed to happen all the time.

So the bank goes bust – or the government bails them out. The financial house of cards collapses, and a million or two million dollars of wealth disappears overnight.

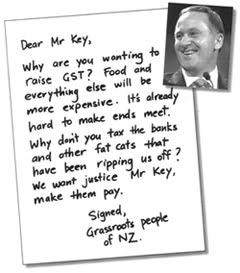

The banking system is unsustainable because it's based on the presumption of eternal economic growth – or, in other words, on the ability of bosses to screw profits out of workers indefinitely. Isn't it time we had a system where credit and growth were supplied for need, not for greed?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment