Sue Bradford's first key grassroots meeting after resigning as Green Party MP

Socialist Worker Forum on

B A D B A N K S

KEYNOTE SPEAKERS:

SUE BRADFORD

("I'm still a radical" after a decade in Parliament)

DAPHNE LAWLESS

(UNITY journal editor)

7.30pm this Thursday, 1st October

Socialist Centre, 86 Princes Street, Onehunga, Auckland

This educational forum is part of building a broad campaign against the undemocratic power of big banks, investment drivers of the global economy and, therefore, of the politics of late capitalism. All leftists welcome.

For more information, contact Bronwen i_c_red@slingshot.co.nz or phone the Socialist Centre (09) 634 3984.

24.9.09

BAD BANKS: Targeting late capitalism's exploitation of labour and nature

by GRANT MORGAN

Socialist Worker-New Zealand

World capitalism's boosters, led by US Federal Reserve chair Ben Bernanke, are welcoming economic "green shoots" and proclaiming "the end of recession".

Nobody has a crystal ball, and yes, at some stage the global economy will start to recover, even if only partially and temporarily. But we need to look at the bigger picture if we are to have any idea of what might lie ahead.

SHARE MARKET BUBBLE

At present, the economic "recovery" is first and foremost a recovery in share market prices, while global unemployment continues to rise and real wages are being driven down.

The levels of unemployment and wages are a much safer way to assess the real state of the real economy than share market fluctuations. What we are now seeing is a share market bubble disconnected from rising unemployment and falling real wages.

Late capitalism increasingly depends on financial and asset bubbles which are disconnected from the real economy.

PROFITABILITY CRISIS

Obviously, that means financial and economic instability is going to be not only more endemic than during early or middle capitalism, but also more catastrophic in its effects. That we saw during the Great Implosion of September 2008 which came close to collapsing the world system's financial structures.

Late capitalism's increasing dependency on financial and asset bubbles is a key symptom of something deeper. The world system is finding it much harder to translate the mega-accumulation of capital into the maximised profit margins which alone can sustain the global rule of ever fewer monopolists.

Many analysts have pointed to the increasing disconnect between rising labour productivity and falling consumer demand, leaving the world economy awash with unwanted consumer goods and excess productive capacity. That is an obvious driver of the world system's profitability crisis.

REVENGE OF NATURE

But there are other drivers as well. Hand-in-hand with the exploitation of labour, the exploitation of nature is creating an existential gulf between human sustainability and corporate profitability.

Since its birth 500 years ago, capitalism has been dependent on the free lunches provided by labour and nature. Without the state-sanctioned looting of nature, the world system could not meet its profit needs, any more than it could without the state-sanctioned wage slavery of workers.

Now we are seeing the revenge of nature, most notably in the rising tides of global warming, but also in the resource depletion and chain-reaction pollution which will intersect with climate change in dangerously unpredictable ways.

TERMINAL CANCERS

Unless checked by a global mobilisation, climate change will kill millions and perhaps billions of people on the planet, unleashing a mega-crisis which kills capitalism. Yet any such global mobilisation will fatally undermine corporate profitability and thus kill capitalism anyway, maybe even quicker.

Late capitalism is being eaten away by terminal cancers.

Yet we cannot simply stand by and wait for something better. The elites who run late capitalism will stop at nothing to transfer their power and privileges to a post-capitalist world which is almost certain to be even more barbaric. That is the road to a mass die-back of humanity and other life forms.

MANY GOOD CAUSES

So the question is: what can we do, right here and right now, to prepare the ground for a post-capitalist world which is more democratic, more equitable and more ecological than the present system.

There is no single or simple answer to that question. The struggles of many leftists in many countries around many causes all help, cumulatively, to make the grassroots stronger and the elites weaker.

Among the good causes that New Zealand leftists are currently promoting are the living wage, climate justice and pro-MMP campaigns.

ASYMMETRIC WARFARE

There exists a vital need to shape all such campaigns into a sharper challenge to the world system which creates the evils that necessitate the campaigns in the first place. Otherwise we are forever fighting the symptoms, leaving the system's elites far too much leeway to perpetuate themselves.

Yet any call to "fight capitalism" would lack mass appeal because it's too distant from most people's consciousness and capabilities.

How then can we proceed? The fundamental principle of asymmetric warfare, where the weak confront the strong, is to strike wherever the enemy is most exposed and wherever the most damage can be inflicted.

WIDESPREAD PUBLIC HOSTILITY

The big banks, whose colossal investments shape the very structures of all economies and, therefore, their governing politics and ideologies, are already the object of widespread public hostility.

If we direct our fire against the big banks, and get a good public response, then late capitalism will be weakened at an increasingly vulnerable yet important spot: the financialisation of the world system.

That is the strategic objective of Socialist Worker's Bad Banks campaign, launched in Auckland not long ago. It is an objective in harmony with the fundamental principle of asymmetric warfare.

WIDESPREAD PUBLIC SUPPORT

The Bad Banks campaign targets the key investment drivers who are responsible for rising unemployment, falling real wages, climate change and other evils flowing from capitalism's exploitation of labour and nature.

It is therefore a campaign which fingers the causes as well as the consequences of the evils of late capitalism. And going by early results at Bad Banks street stalls, there is widespread public support for the campaign.

To help out at a Bad Banks stall, email socialist-worker@pl.net.

Socialist Worker-New Zealand

World capitalism's boosters, led by US Federal Reserve chair Ben Bernanke, are welcoming economic "green shoots" and proclaiming "the end of recession".

Nobody has a crystal ball, and yes, at some stage the global economy will start to recover, even if only partially and temporarily. But we need to look at the bigger picture if we are to have any idea of what might lie ahead.

SHARE MARKET BUBBLE

At present, the economic "recovery" is first and foremost a recovery in share market prices, while global unemployment continues to rise and real wages are being driven down.

The levels of unemployment and wages are a much safer way to assess the real state of the real economy than share market fluctuations. What we are now seeing is a share market bubble disconnected from rising unemployment and falling real wages.

Late capitalism increasingly depends on financial and asset bubbles which are disconnected from the real economy.

PROFITABILITY CRISIS

Obviously, that means financial and economic instability is going to be not only more endemic than during early or middle capitalism, but also more catastrophic in its effects. That we saw during the Great Implosion of September 2008 which came close to collapsing the world system's financial structures.

Late capitalism's increasing dependency on financial and asset bubbles is a key symptom of something deeper. The world system is finding it much harder to translate the mega-accumulation of capital into the maximised profit margins which alone can sustain the global rule of ever fewer monopolists.

Many analysts have pointed to the increasing disconnect between rising labour productivity and falling consumer demand, leaving the world economy awash with unwanted consumer goods and excess productive capacity. That is an obvious driver of the world system's profitability crisis.

REVENGE OF NATURE

But there are other drivers as well. Hand-in-hand with the exploitation of labour, the exploitation of nature is creating an existential gulf between human sustainability and corporate profitability.

Since its birth 500 years ago, capitalism has been dependent on the free lunches provided by labour and nature. Without the state-sanctioned looting of nature, the world system could not meet its profit needs, any more than it could without the state-sanctioned wage slavery of workers.

Now we are seeing the revenge of nature, most notably in the rising tides of global warming, but also in the resource depletion and chain-reaction pollution which will intersect with climate change in dangerously unpredictable ways.

TERMINAL CANCERS

Unless checked by a global mobilisation, climate change will kill millions and perhaps billions of people on the planet, unleashing a mega-crisis which kills capitalism. Yet any such global mobilisation will fatally undermine corporate profitability and thus kill capitalism anyway, maybe even quicker.

Late capitalism is being eaten away by terminal cancers.

Yet we cannot simply stand by and wait for something better. The elites who run late capitalism will stop at nothing to transfer their power and privileges to a post-capitalist world which is almost certain to be even more barbaric. That is the road to a mass die-back of humanity and other life forms.

MANY GOOD CAUSES

So the question is: what can we do, right here and right now, to prepare the ground for a post-capitalist world which is more democratic, more equitable and more ecological than the present system.

There is no single or simple answer to that question. The struggles of many leftists in many countries around many causes all help, cumulatively, to make the grassroots stronger and the elites weaker.

Among the good causes that New Zealand leftists are currently promoting are the living wage, climate justice and pro-MMP campaigns.

ASYMMETRIC WARFARE

There exists a vital need to shape all such campaigns into a sharper challenge to the world system which creates the evils that necessitate the campaigns in the first place. Otherwise we are forever fighting the symptoms, leaving the system's elites far too much leeway to perpetuate themselves.

Yet any call to "fight capitalism" would lack mass appeal because it's too distant from most people's consciousness and capabilities.

How then can we proceed? The fundamental principle of asymmetric warfare, where the weak confront the strong, is to strike wherever the enemy is most exposed and wherever the most damage can be inflicted.

WIDESPREAD PUBLIC HOSTILITY

The big banks, whose colossal investments shape the very structures of all economies and, therefore, their governing politics and ideologies, are already the object of widespread public hostility.

If we direct our fire against the big banks, and get a good public response, then late capitalism will be weakened at an increasingly vulnerable yet important spot: the financialisation of the world system.

That is the strategic objective of Socialist Worker's Bad Banks campaign, launched in Auckland not long ago. It is an objective in harmony with the fundamental principle of asymmetric warfare.

WIDESPREAD PUBLIC SUPPORT

The Bad Banks campaign targets the key investment drivers who are responsible for rising unemployment, falling real wages, climate change and other evils flowing from capitalism's exploitation of labour and nature.

It is therefore a campaign which fingers the causes as well as the consequences of the evils of late capitalism. And going by early results at Bad Banks street stalls, there is widespread public support for the campaign.

To help out at a Bad Banks stall, email socialist-worker@pl.net.

19.9.09

What's a “Fractional Reserve”?

by Daphne Lawless

UNITY Journal Editor

Simply put, “fractional reserve lending” is the reason why confidence is so important to banks.

Banks don't have to have assets on hand to cover all the loans they issue. In New Zealand, they only need to hang on to 4% of the loans they make for housing – and 8% of other types of loan.

Banks can't just make money up. If they want to lend out $100,000, say, they do need to have that money on their books to start with – from deposits, or from a central government monetary issue.

But the “fractional reserve” rule mean that they don't have to hang on to those reserves when they make loans. If a bank lends $100,000 to a business, they only need to hang on to $8,000 in their own vaults. And only $4,000 if it's for a mortgage.

One benefit of this is that money goes further, and faster. Because that $100,000 that has been lent out will end up as deposits in that same bank, or in other banks.

And then it can be loaned out again – except for the $4,000 or $8,000 reserve. So that's another $92,000 or even $96,000 back into circulation!

This is where we get what is called the “multiplier” effect. Because any initial deposit, or central bank issue, can be loaned out again and again and again, its actual effect on the economy will be much, much bigger than the initial input.

So $100,000 which is made available to business, because it gets loaned out again and again, actually means something like $1,250,000 gets added to the economy. And with housing loans, that becomes a massive $2,500,000!

The flaw in all of this, however, is that it means the system is all down to confidence.

Capitalism needs a constantly growing and expanding economy. Anyone making a loan needs to be pretty sure that they will make enough money to pay it back, and the interest, in the future.

So all this massive creation of credit - $1 million or more, or even $2 million or more – relies on the lenders' confidence in their ability to get it all back, once it's invested. It also relies on the confidence of the depositors – the people who paid in the $100,000 in the first place – that they too will get their money back, with interest.

But what happens when that confidence disappears? It's called a run on the banks.

If depositors have reason to believe that their deposits aren't safe, they run directly to the banks to ask for their deposits back. And of course the banks don't have those deposits – apart from the 4% or 8% that the law required them to keep back.

In some cases, the money in those deposits will have been loaned out, then redeposited by someone else, then loaned out again, then redeposited, over and over and over. That's fine when economic growth means everyone wins. But that can't be guaranteed to happen all the time.

So the bank goes bust – or the government bails them out. The financial house of cards collapses, and a million or two million dollars of wealth disappears overnight.

The banking system is unsustainable because it's based on the presumption of eternal economic growth – or, in other words, on the ability of bosses to screw profits out of workers indefinitely. Isn't it time we had a system where credit and growth were supplied for need, not for greed?

UNITY Journal Editor

Simply put, “fractional reserve lending” is the reason why confidence is so important to banks.

Banks don't have to have assets on hand to cover all the loans they issue. In New Zealand, they only need to hang on to 4% of the loans they make for housing – and 8% of other types of loan.

Banks can't just make money up. If they want to lend out $100,000, say, they do need to have that money on their books to start with – from deposits, or from a central government monetary issue.

But the “fractional reserve” rule mean that they don't have to hang on to those reserves when they make loans. If a bank lends $100,000 to a business, they only need to hang on to $8,000 in their own vaults. And only $4,000 if it's for a mortgage.

One benefit of this is that money goes further, and faster. Because that $100,000 that has been lent out will end up as deposits in that same bank, or in other banks.

And then it can be loaned out again – except for the $4,000 or $8,000 reserve. So that's another $92,000 or even $96,000 back into circulation!

This is where we get what is called the “multiplier” effect. Because any initial deposit, or central bank issue, can be loaned out again and again and again, its actual effect on the economy will be much, much bigger than the initial input.

So $100,000 which is made available to business, because it gets loaned out again and again, actually means something like $1,250,000 gets added to the economy. And with housing loans, that becomes a massive $2,500,000!

The flaw in all of this, however, is that it means the system is all down to confidence.

Capitalism needs a constantly growing and expanding economy. Anyone making a loan needs to be pretty sure that they will make enough money to pay it back, and the interest, in the future.

So all this massive creation of credit - $1 million or more, or even $2 million or more – relies on the lenders' confidence in their ability to get it all back, once it's invested. It also relies on the confidence of the depositors – the people who paid in the $100,000 in the first place – that they too will get their money back, with interest.

But what happens when that confidence disappears? It's called a run on the banks.

If depositors have reason to believe that their deposits aren't safe, they run directly to the banks to ask for their deposits back. And of course the banks don't have those deposits – apart from the 4% or 8% that the law required them to keep back.

In some cases, the money in those deposits will have been loaned out, then redeposited by someone else, then loaned out again, then redeposited, over and over and over. That's fine when economic growth means everyone wins. But that can't be guaranteed to happen all the time.

So the bank goes bust – or the government bails them out. The financial house of cards collapses, and a million or two million dollars of wealth disappears overnight.

The banking system is unsustainable because it's based on the presumption of eternal economic growth – or, in other words, on the ability of bosses to screw profits out of workers indefinitely. Isn't it time we had a system where credit and growth were supplied for need, not for greed?

16.9.09

Latest UNITY Journal on Bad Banks

Bad Banks, & how to beat them

September 2009

TABLE OF CONTENTS

5 Bank on a massive campaign

Daphne Lawless, editor of UNITY

11 Why we need to battle the banks

VAUGHAN GUNSON, national chair of Socialist Worker NZ

17 The banks and the Great Implosion

VAUGHAN GUNSON

30 New Zealand’s recession - is the worst over?

ANTHONY Main, Socialist Party (Australia)

34 Are the banks helping?

BILL ROSENBERG, NZ Council of Trade Unions economist

38 A Green response to global market failure

CATHERINE DELAHUNTY and KEVIN HAGUE, Green MPs (New Zealand)

43 International banks exploit the crisis

STEFAN STEINBERG, World Socialist Web Site

47 Are the banks to blame?

Anindya Bhattacharyya and Sadie Robinson, Socialist Worker (Britain)

52 Banks go back to bubble bonuses

ALEX CALLINICOS, Socialist Worker (Britain)

54 The recovery is here! (for Wall Street)

Adam Turl and Alan Maass, Socialist Worker (USA)

60 How the bankers bought Congress

PETRINO DILEO, Socialist Worker (USA)

65 Iceland - what happened?

JACK SMART, Socialist Appeal (Britain)

69 Iceland: devastated by global crisis

Per-Åke Westerlund, Committee for a Workers’ International

72 Can the Left-Greens rescue Iceland?

DEREK WALL, Green Left Network (Britain)

75 Australia: Banks are bastards

PETER ROBSON, Green Left Weekly (Australia)

77 Mexico: Protests target banks

RACHEL EVANS, Green Left Weekly (Australia)

78 Communal banks of Venezuela receive big boost

TAMARA PEARSON, http://www.venezuelanalysis.com/

80 Venezuela will take over private banks that fail

JAMES SUGGETT, http://www.venezuelanalysis.com/

81 Feedback: Letters from Peter de Waal, Bronwen Beechey and Pat O’Dea

To purchase a copy email socialist-worker@pl.net

For details on how to subscribe to UNITY Journal go to New subscription to UNITY Journal

5.9.09

Banking operations pushing us towards trans-Tasman integration

by Vaughan Gunson

Bernard Hickey's blog post Single currency gaining speed (6 Sept) on the NZ Herald website links the operations of the Aussie-owned banks with moves towards increased trans-Tasman economic and political integration, specifically one dollar and common banking regulations.

As the Aussie parent banks are only interested in making as much profit as possible, and the role of the Australian state is to facilitate the making of those profits, the dominant position of the Aussie-owned banks in the NZ economy is resulting in ever greater political dominance of Australia over NZ.

The Rudd government and the Aussie parent banks are making much of the claim that they've been propping up the NZ economy post-financial crisis, through the Australian government's credit guarantee scheme and the parent banks loaning across the Tasman to support the operations of the Big Four in NZ. The reality of mega-profits been sucked out of NZ, chiefly through mortgage lending, over the preceding decade is of course disregarded. And today, the Big Four banks operating in NZ are continuing their profit run at the expense of grassroots Kiwi homeowners.

What's clear is that the operations of the Aussie-owned banks in NZ is propelling forward increased integration of the Australian and NZ economies, to the benefit of the former.

The question of NZ's eroding political sovereignty is one that many people will be interested in. The Bad Banks campaign has the potential to tap into a number of economic and political issues of popular concern, and which go to the heart of 21st century finance capitalism.

Bernard Hickey's blog post Single currency gaining speed (6 Sept) on the NZ Herald website links the operations of the Aussie-owned banks with moves towards increased trans-Tasman economic and political integration, specifically one dollar and common banking regulations.

As the Aussie parent banks are only interested in making as much profit as possible, and the role of the Australian state is to facilitate the making of those profits, the dominant position of the Aussie-owned banks in the NZ economy is resulting in ever greater political dominance of Australia over NZ.

The Rudd government and the Aussie parent banks are making much of the claim that they've been propping up the NZ economy post-financial crisis, through the Australian government's credit guarantee scheme and the parent banks loaning across the Tasman to support the operations of the Big Four in NZ. The reality of mega-profits been sucked out of NZ, chiefly through mortgage lending, over the preceding decade is of course disregarded. And today, the Big Four banks operating in NZ are continuing their profit run at the expense of grassroots Kiwi homeowners.

What's clear is that the operations of the Aussie-owned banks in NZ is propelling forward increased integration of the Australian and NZ economies, to the benefit of the former.

The question of NZ's eroding political sovereignty is one that many people will be interested in. The Bad Banks campaign has the potential to tap into a number of economic and political issues of popular concern, and which go to the heart of 21st century finance capitalism.

4.9.09

Mega-rich bankers are squeezing the world

Text from the back page of Bad Banks leaflet #1.

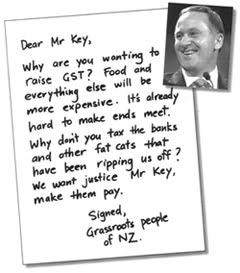

The cartoon (above) shows a “fat cat” sitting on people. It’s a comical image. Unfortunately it shows a sad truth. Around the world today this is what’s happening to grassroots people like us.

The fallout from the global economic crisis is leading to millions losing their jobs. In the US, the world’s biggest economy, 1 in 6 workers are out of work. 50% of homeowners risk losing their homes.

As economies slump governments are cutting spending on health, education and other services, making things worse for grassroots people.

But while this is going on, trillions of dollars have been raised to bailout banks and other financial institutions, the very ones behind the meltdown.

Big banks, like the US based Goldman Sachs, exert enormous influence over markets. They helped inflate the global “housing bubble”.

Grassroots people all over the world got caught up in the house price spike, forced to take out big loans to buy a home. The banks, media and politicians told us it was OK. House prices, they said, would continue to rise and we’d all be better off.

This was a lie, one the banks, media and politicians were happy to peddle because all this borrowing was making a few people super-rich.

But it couldn’t last, the wages of ordinary people weren’t going up in line with house prices. It all came unstuck in 2007 when house prices in the US and elsewhere fell and indebted homeowners began defaulting on their mortgages. This caught out most of the world’s banks who all had a finger in the “housing bubble” pie.

With trillions of dollars of “bad debt” on their books the banks stopped lending. Because so much of today’s economy is founded on borrowing (by governments, business and ordinary people) to have credit freeze up was a nightmare scenario for the Kings of Capital.

To keep the profits flowing governments wrote blank cheques for the banks. A recent report calculated that the bailout figure for the US alone is expected to climb to $23.7 trillion!

The global economy, however, is still nose-diving, leading to a pandemic of job losses.

Yet out of this social misery many of the big banks are returning to profitability. Goldman Sachs is posting record profits. These mega-rich bankers are set on dominating like never before the creation of credit. They’re lending to cash-strapped governments at high interest rates. They’re speculating again in financial markets. It’s “win-win” for them and “lose-lose” for us.

A system that can divert trillions of dollars to a mega-rich minority and let the majority fend for themselves is an unjust one. The fat cats are sitting on top of us. And that has to be changed. The Bad Banks campaign is where it starts.

The cartoon (above) shows a “fat cat” sitting on people. It’s a comical image. Unfortunately it shows a sad truth. Around the world today this is what’s happening to grassroots people like us.

The fallout from the global economic crisis is leading to millions losing their jobs. In the US, the world’s biggest economy, 1 in 6 workers are out of work. 50% of homeowners risk losing their homes.

As economies slump governments are cutting spending on health, education and other services, making things worse for grassroots people.

But while this is going on, trillions of dollars have been raised to bailout banks and other financial institutions, the very ones behind the meltdown.

Big banks, like the US based Goldman Sachs, exert enormous influence over markets. They helped inflate the global “housing bubble”.

Grassroots people all over the world got caught up in the house price spike, forced to take out big loans to buy a home. The banks, media and politicians told us it was OK. House prices, they said, would continue to rise and we’d all be better off.

This was a lie, one the banks, media and politicians were happy to peddle because all this borrowing was making a few people super-rich.

But it couldn’t last, the wages of ordinary people weren’t going up in line with house prices. It all came unstuck in 2007 when house prices in the US and elsewhere fell and indebted homeowners began defaulting on their mortgages. This caught out most of the world’s banks who all had a finger in the “housing bubble” pie.

With trillions of dollars of “bad debt” on their books the banks stopped lending. Because so much of today’s economy is founded on borrowing (by governments, business and ordinary people) to have credit freeze up was a nightmare scenario for the Kings of Capital.

To keep the profits flowing governments wrote blank cheques for the banks. A recent report calculated that the bailout figure for the US alone is expected to climb to $23.7 trillion!

The global economy, however, is still nose-diving, leading to a pandemic of job losses.

Yet out of this social misery many of the big banks are returning to profitability. Goldman Sachs is posting record profits. These mega-rich bankers are set on dominating like never before the creation of credit. They’re lending to cash-strapped governments at high interest rates. They’re speculating again in financial markets. It’s “win-win” for them and “lose-lose” for us.

A system that can divert trillions of dollars to a mega-rich minority and let the majority fend for themselves is an unjust one. The fat cats are sitting on top of us. And that has to be changed. The Bad Banks campaign is where it starts.

2.9.09

“We need a full public inquiry into banking operations,” say Bad Banks campaigners

Bad Banks media release

2 September 2009

The operations of the Big Four Aussie-owned banks are harmful to the lives of ordinary Kiwis,” says Vaughan Gunson, publicity coordinator for Bad Banks, a recently initiated grassroots campaign against banking power.

ANZ National Bank, BNZ, Westpac and ASB have been making mega-profits from interest gouging grassroots Kiwis. In 2008, their combined income from loan interest went up $4.6 billion. Last year the profits of the Big Four totaled over $3 billion.

“And now, in a recession, these Bad Banks are king-hitting people who have lost their jobs or had their incomes cut,” says Gunson. “They’re inflicting penalties on people who can’t meet their mortgage payments and forcing mortgagee sales in increasing numbers.”

“They’re looking after their own equity position and chucking people out of their homes. It’s disgusting. These Bad Banks are part of a corporate culture of greed that’s sucking the life out of this country,” says Gunson.

While it's good that the Green, Labour and Progressive parties have gone ahead with their banking inquiry, the time frame for submissions was very short. That means there are only 11 oral submissions.

“11 oral submissions does not do justice to the devastating impact banking power is having on the lives of grassroots Kiwis,” says Gunson. “We need a full public inquiry, properly resourced and promoted, so that grassroots people can have their say and the Aussie-owned banks be held to account.”

“Any full public inquiry should allow for public meetings up and down the country, so that grassroots people can tell their stories.”

“We hope that MPs in the Green, Labour and Progressive parties are going to be part of an ongoing campaign against the banks,” says Gunson. “We need to confront corporate power full-on.”

The first goal of the Bad Banks campaign is to educate people about the operations of the banks. Bad Banks activists will be out on the streets in Auckland and other cities handing out leaflets and talking to people over the coming weeks and months.

“People can find out more about Bad Banks by going to our webpage www.badbanks.co.nz. We welcome any stories or comments on the banks,” says Gunson. “We’re looking to reach out to other groups, organisations and individuals to help build this campaign.”

2 September 2009

The operations of the Big Four Aussie-owned banks are harmful to the lives of ordinary Kiwis,” says Vaughan Gunson, publicity coordinator for Bad Banks, a recently initiated grassroots campaign against banking power.

ANZ National Bank, BNZ, Westpac and ASB have been making mega-profits from interest gouging grassroots Kiwis. In 2008, their combined income from loan interest went up $4.6 billion. Last year the profits of the Big Four totaled over $3 billion.

“And now, in a recession, these Bad Banks are king-hitting people who have lost their jobs or had their incomes cut,” says Gunson. “They’re inflicting penalties on people who can’t meet their mortgage payments and forcing mortgagee sales in increasing numbers.”

“They’re looking after their own equity position and chucking people out of their homes. It’s disgusting. These Bad Banks are part of a corporate culture of greed that’s sucking the life out of this country,” says Gunson.

While it's good that the Green, Labour and Progressive parties have gone ahead with their banking inquiry, the time frame for submissions was very short. That means there are only 11 oral submissions.

“11 oral submissions does not do justice to the devastating impact banking power is having on the lives of grassroots Kiwis,” says Gunson. “We need a full public inquiry, properly resourced and promoted, so that grassroots people can have their say and the Aussie-owned banks be held to account.”

“Any full public inquiry should allow for public meetings up and down the country, so that grassroots people can tell their stories.”

“We hope that MPs in the Green, Labour and Progressive parties are going to be part of an ongoing campaign against the banks,” says Gunson. “We need to confront corporate power full-on.”

The first goal of the Bad Banks campaign is to educate people about the operations of the banks. Bad Banks activists will be out on the streets in Auckland and other cities handing out leaflets and talking to people over the coming weeks and months.

“People can find out more about Bad Banks by going to our webpage www.badbanks.co.nz. We welcome any stories or comments on the banks,” says Gunson. “We’re looking to reach out to other groups, organisations and individuals to help build this campaign.”

Subscribe to:

Comments (Atom)